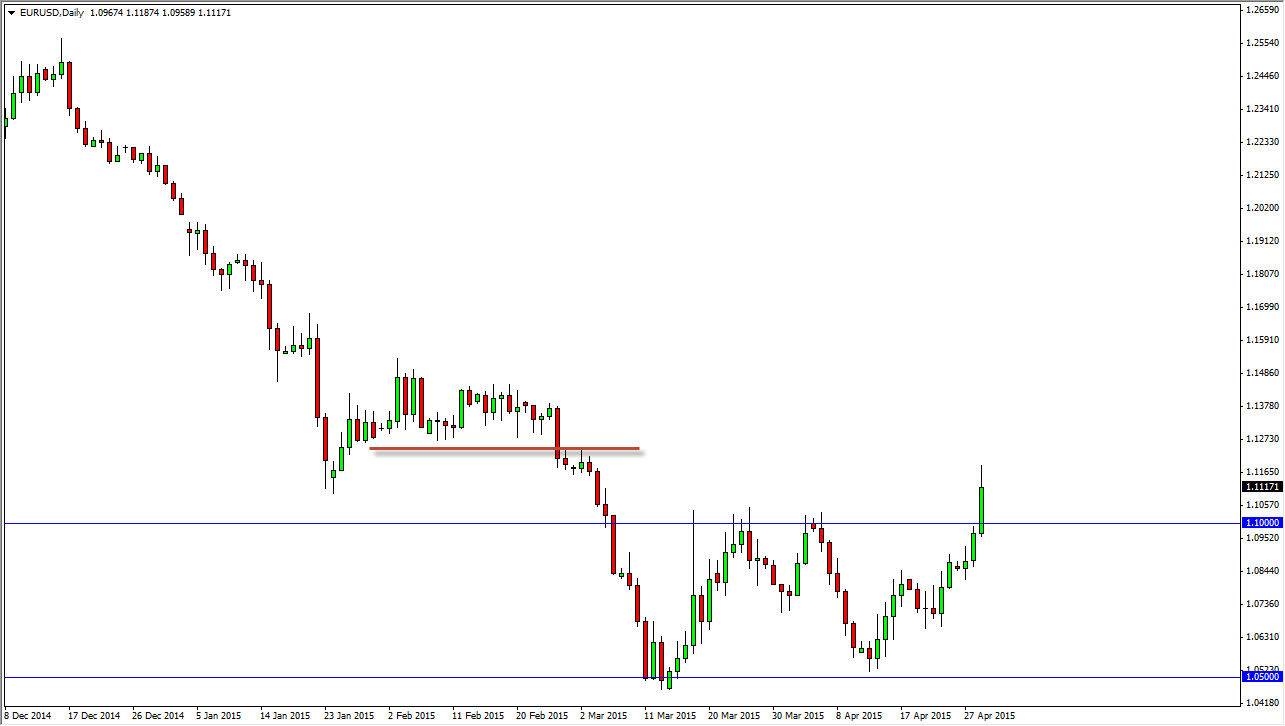

The EUR/USD pair broke down during the course of the session on Wednesday, clearing the 1.10 level with relative ease. This was due mainly to the fact that the US GDP numbers disappointed, and in a big way. With that, traders began to bet that the Federal Reserve would have to keep its monetary policy rather loose, and for longer than anticipated. If that’s the case, the market has been wrong for some time and has to retrace some of its steps. However, I cannot help but notice that the market sold off a significant amount towards the end of the day as the Federal Reserve statement wasn't exactly anymore dovish than it had been previously. I think there’s a lot of confusion out there at the moment.

I see the 1.12 level as being rather important, and with that I think it’s only a matter of time before we run into a significant amount of resistance every time we get there. I also see a cluster of resistance all the way up to the 1.15 handle but I do recognize that above the 1.15 handle, we essentially have seen a trend change. I think we’re going to see quite a bit of volatility in the short-term, and quite frankly I don’t really have too much interest in it.

Short-term range

I think it is likely that we see a bit of range between 1.10 and 1.12 or so. I don’t like these types of moves, because they essentially are fighting an uphill battle. You can’t really sell this type of action, we certainly can’t buy it either. The only way to trade this type of market as if you’re willing to take 20 pips at a time, which quite frankly just isn’t my style. I’d rather sit back and wait for a clear signal and try to pick up a few hundred. I don’t think that’s possible in this market right now, so quite frankly I am on the sidelines and quite comfortable being there.