EUR/USD Signal Update

Yesterday’s signals were not triggered as although the price did reach 1.0550 there was no bullish price action there.

Today’s EUR/USD Signals

Risk 0.75%

Trades must be entered before 5pm London time today only.

Long Trade 1

Long entry following a bullish price action reversal on the H1 time frame immediately upon the retest of the broken bearish trend line currently sitting at around 1.0460.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.0630.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

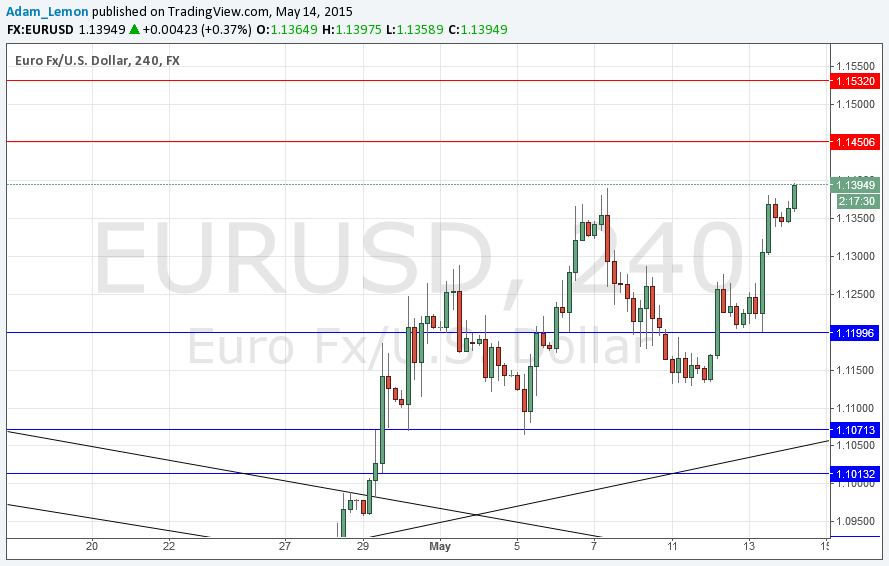

EUR/USD Analysis

I wrote yesterday that the picture looks bearish and the pair has indeed continued to fall, albeit slowly. The action has been more or less straight down for a while and we may be due some kind of pull back. However increasing fears over an impasse in the Greek negotiations are leading to a perception of an increased probability in a Greek exit from the Euro, which is making the Euro stand out as a very weak currency right now. Therefore sudden news one way or another could have a big and immediate effect on the price here.

There is the same probably resistance above at 1.0630. There are no obvious horizontal support levels but there is a broken bearish trend line that acted as a launch pad before and might provide support again, giving a long opportunity.

There are no high-impact events scheduled later today concerning the EUR. Regarding the USD, at 1:30pm London time there will be releases of Retail Sales and PPI data.

.