EUR/USD Signal Update

Yesterday’s signals were not triggered as the price did not reach either 1.0440 or 1.0711 during the London session.

Today’s EUR/USD Signals

Risk 0.75%

Trades must be taken before 5pm London time only.

Long Trade 1

Long entry following a bullish price action reversal on the H1 time frame immediately upon the retest of the broken bearish trend line currently sitting at around 1.0430.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.0800.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

EUR/USD Analysis

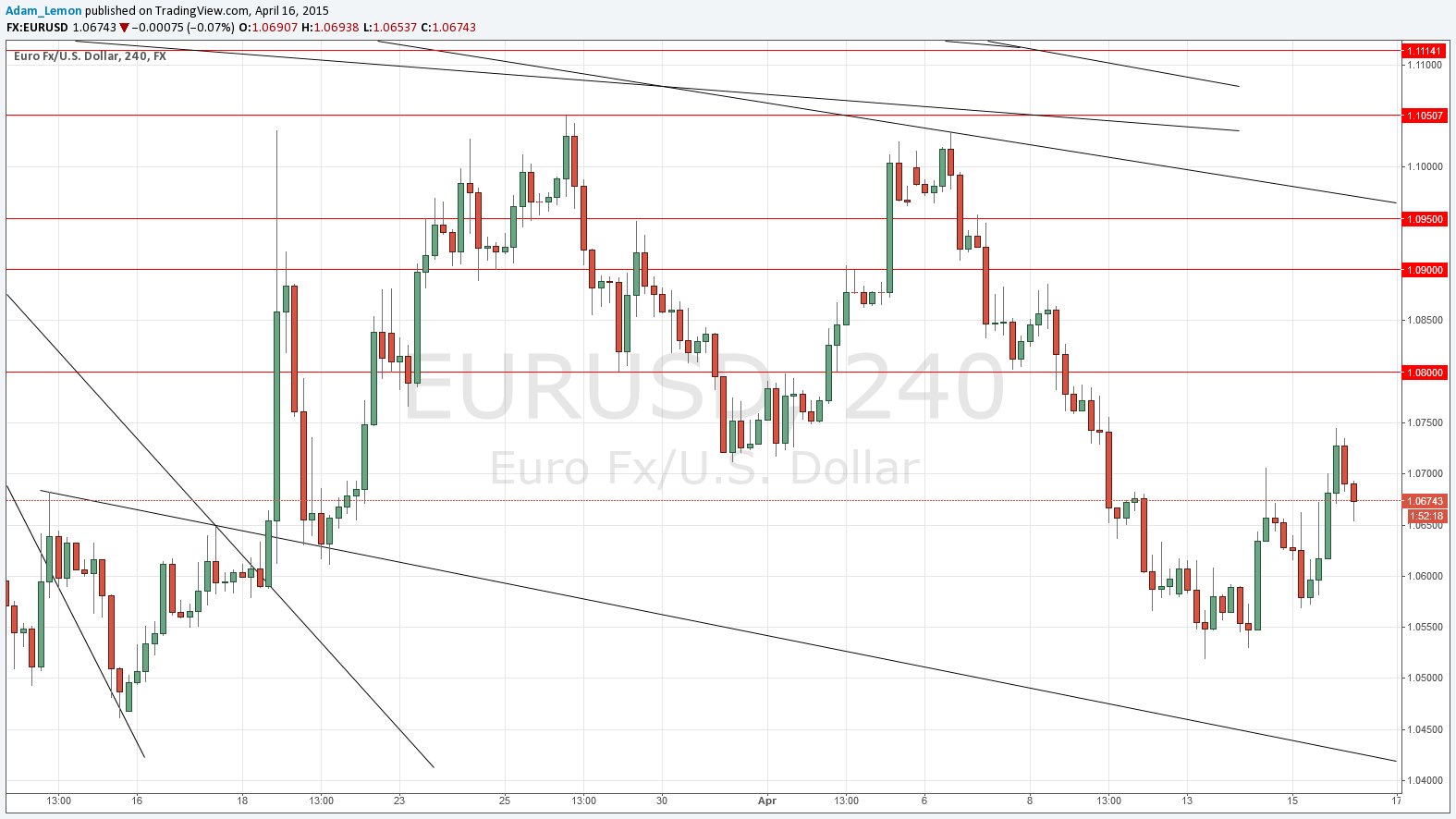

Yesterday was a strange day. Late in the ECB Press Conference the price climbed before falling off steadily to the London close, after which it again rose to regain its heights. We are seeing some bullishness and a break above the resistance that was located close to 1.0700.

The pair is really within a no-man’s-land now, without any clear levels nearby. It is very hard to say what will happen next as the shine seems to be coming off the USD which has fallen significantly against other major pairs.

We remain within a very wide bearish channel overall.

There are high-impact events scheduled today concerning the USD but not the EUR. At 1:30pm London time there will be a release of Building Permits and Unemployment Claims data, followed later at 3pm by the Philly Fed Manufacturing Index.