EUR/USD Signal Update

Yesterday’s signals were not triggered as the bearish reversal off the 1.0900 zone did not happen until after the London close.

Today’s EUR/USD Signals

Risk 0.75%

Trades may only be taken between 8am and 5pm London time today.

Long Trade 1

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.0800.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.0950.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 2

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.1000.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

EUR/USD Analysis

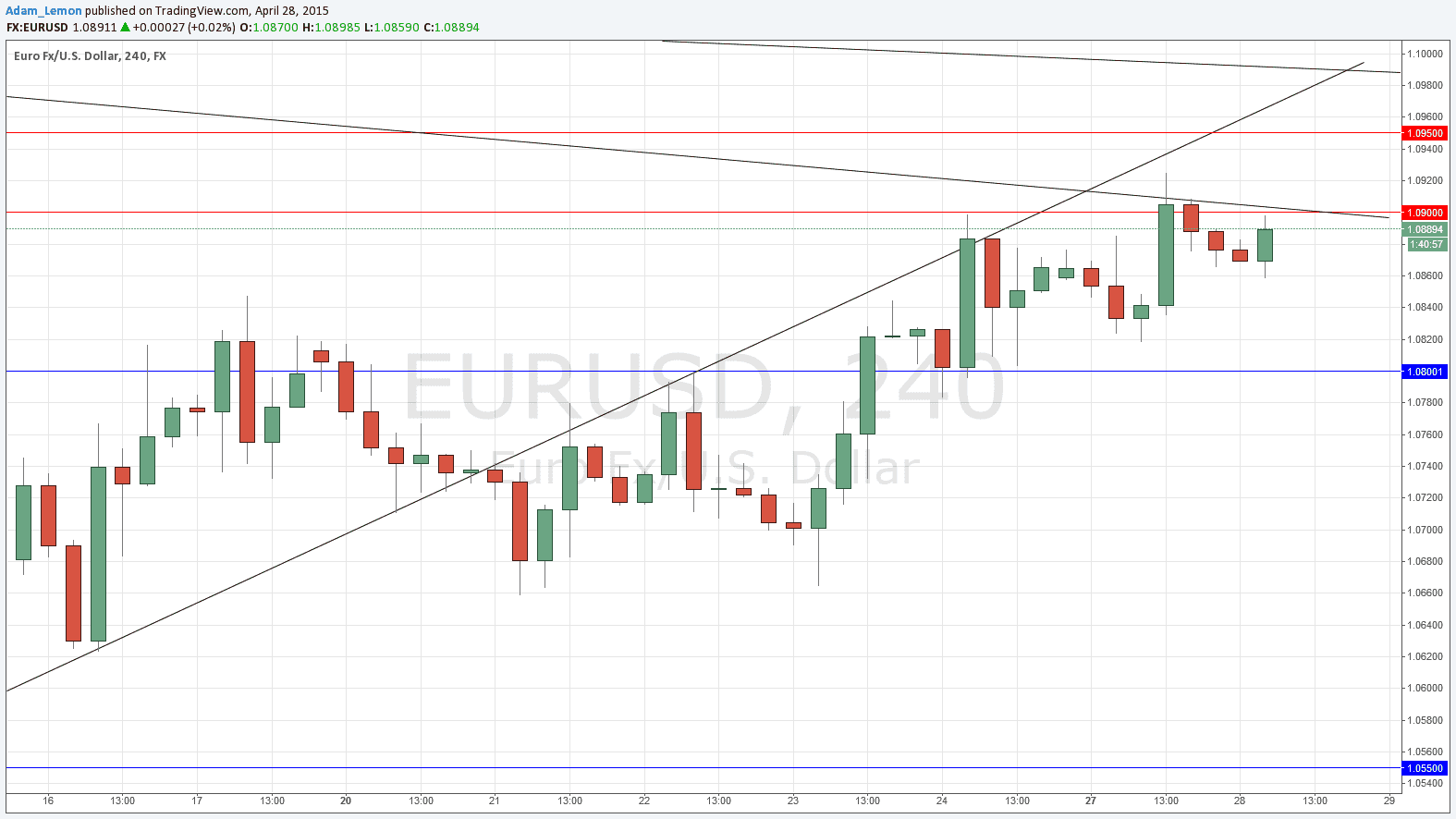

It was a quiet day until the New York session got going at which point the USD weakened across the board. That moves this pair up bullishly until it bounced off the trend line above 1.0900, although this did not happen until the very end of London hours.

At the time of writing the price looks bullish and is gearing up to challenge 1.0900 again.

There is a lot of resistance from 1.0900 to 1.1000, as can be seen in the chart below where several trend lines are shown, so there are several potential opportunities to short off any bearish reversal that may occur up there.

There are no high-impact events scheduled today concerning the EUR. Regarding the USD, there will be a release of CB Consumer Confidence data at 3pm London time.