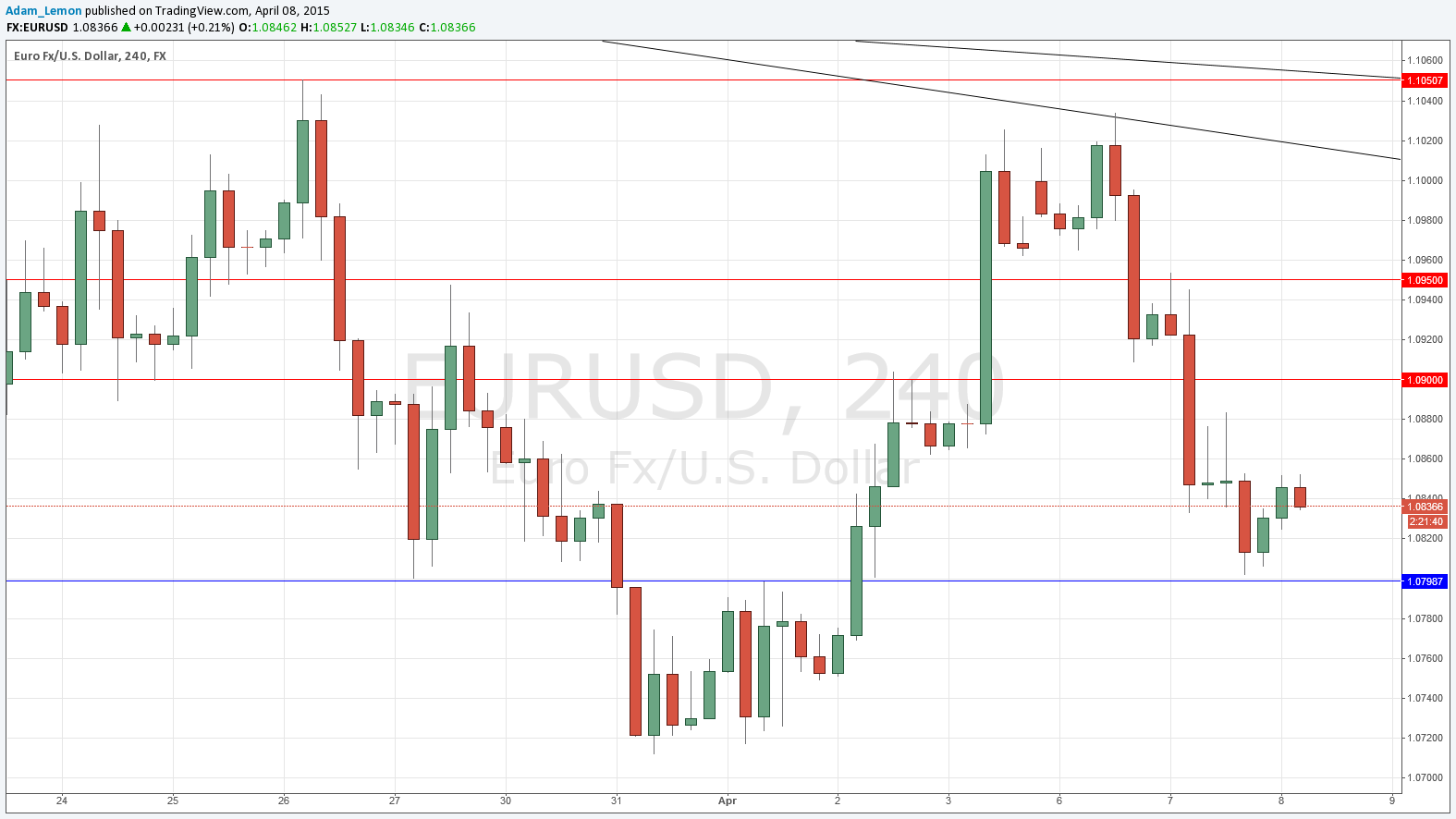

EUR/USD Signal Update

Yesterday’s signals were not triggered as although the price did reach 1.0900 quite early during yesterday’s London session, there was no bullish price action there.

Today’s EUR/USD Signals

Risk 0.75%

Trades must be taken before 5pm London time today.

Protect any open trades before 6:30pm London time tonight.

Long Trade 1

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.0798.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.0900.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 2

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.0950.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

EUR/USD Analysis

It should be quiet today before the FOMC release that will happen later after the London close. Usually under these conditions, clear support and resistance levels are respected. We already had the previously identified support at 1.0800 act as support overnight. Above there is more likely round number resistance at 1.0900 and again at 1.0950.

There are no high-impact events scheduled later today concerning the EUR. Regarding the USD, there will be a release of the FOMC Meeting Minutes at 7pm London time.