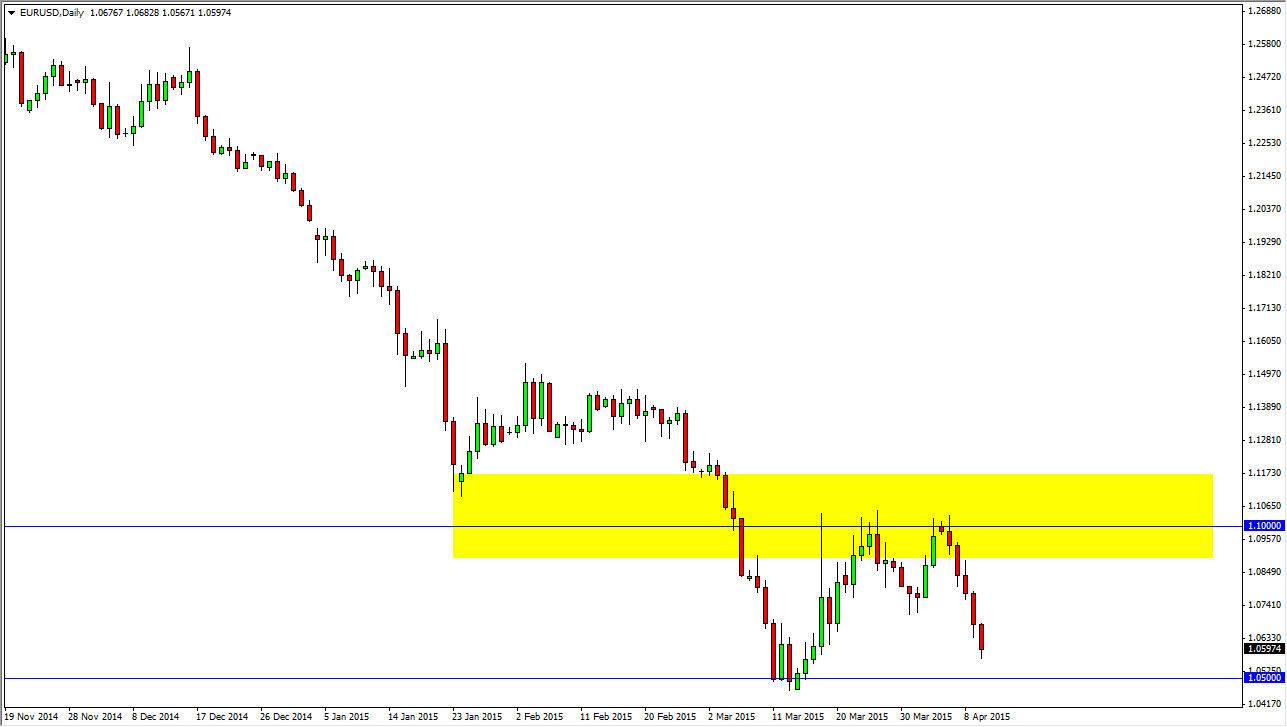

The EUR/USD pair fell again during the session on Friday, as the Euro continues to get punished overall. Keep in mind, not only do we have troubles in Europe, but we have troubles around the world and that essentially makes the US dollar attractive as it is considered to be safe. It certainly looks as if we are heading back down to the 1.05 level, so quite frankly I have no interest in trying to fight that move. I also believe that the 1.05 level will eventually get broken to the downside, but I am not sure it will happen right away. After all, we have fallen significantly over the last couple of days, and it might be a simple matter of a lack of inertia as so many people are now short of this pair again. However, I think that any bounce from the 1.05 level will simply end up being a selling opportunity, so I don’t have any interest in going long.

One-way trade

As far as I can see, the EUR/USD pair continues to be a one-way trade, and as a result I will sell those rallies that appear. You have to look at it as value in the US dollar, and as a result you have to be able to sell every time the market rises. I think that it’s only a matter time before we break down again, and every rally I just look at as a potential selling opportunity again as the US dollar is the favored currency around the world. I do expect this pair to hit the parity level given enough time, so that’s essentially what I’m holding out for.

I would anticipate the mother of all bounces down at the parity level, but I do think that we almost have to test that area at this point in time. I would not consider buying the Euro until we get above the 1.15 handle, something that does not look very likely at this point in time.