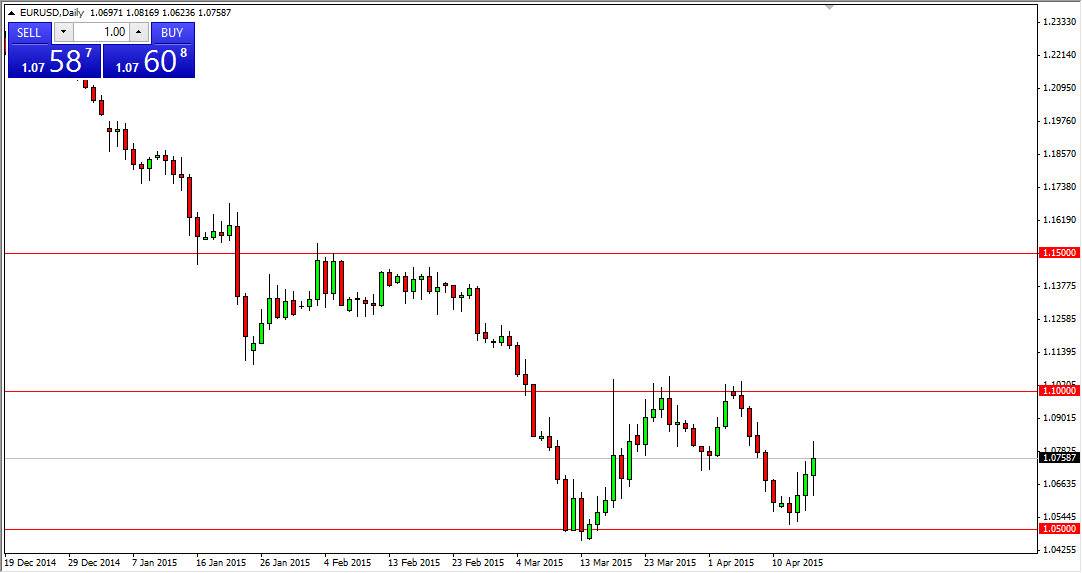

The EUR/USD pair initially fell during the course of the day on Thursday, but not enough support to continue to go much higher. We tested the 1.08 level, which of course is fairly impressive considering how soft the Euro has been recently. With that, I think that perhaps this pair can continue going higher, maybe as high as the 1.10 level. Ultimately, I believe that it’s a matter of time before the seller’s comeback though, so I am more interested in shorting resistive looking candles as they appear. I recognize that they could happen anywhere between here and there, and on any timeframe, but I prefer anything about four hours. After all, there is a lot of noise in this market at the moment, so it’s difficult to base anything off of the short-term charts right now.

I will continue to sell rallies.

I will continue to sell rallies in this market as they appear, mainly because the Euro has so many issues behind it. After all, European Union has struggled for some time now, and although the United States isn't exactly humming along, it is doing better than Europe. Because of this, I feel that this market will continue to have a bit of a black cloud over it, and it’s only a matter of time before we see sellers enter the market after a rally. After all, it’s not that it could take months to scare people holding the Euro, especially as the Greek situation isn’t seemingly done. With that, I believe that rallies offer value in the US dollar, and it will have to be looked at as such.

Not only all of them, but I recognize that there is significant resistance above the 1.10 level as well. Ultimately, I do not feel comfortable buying this pair and so we get above the 1.15 handle, something that isn’t going to happen anytime soon. I figure this market should continue to offer plenty selling opportunities if you are only patient enough.