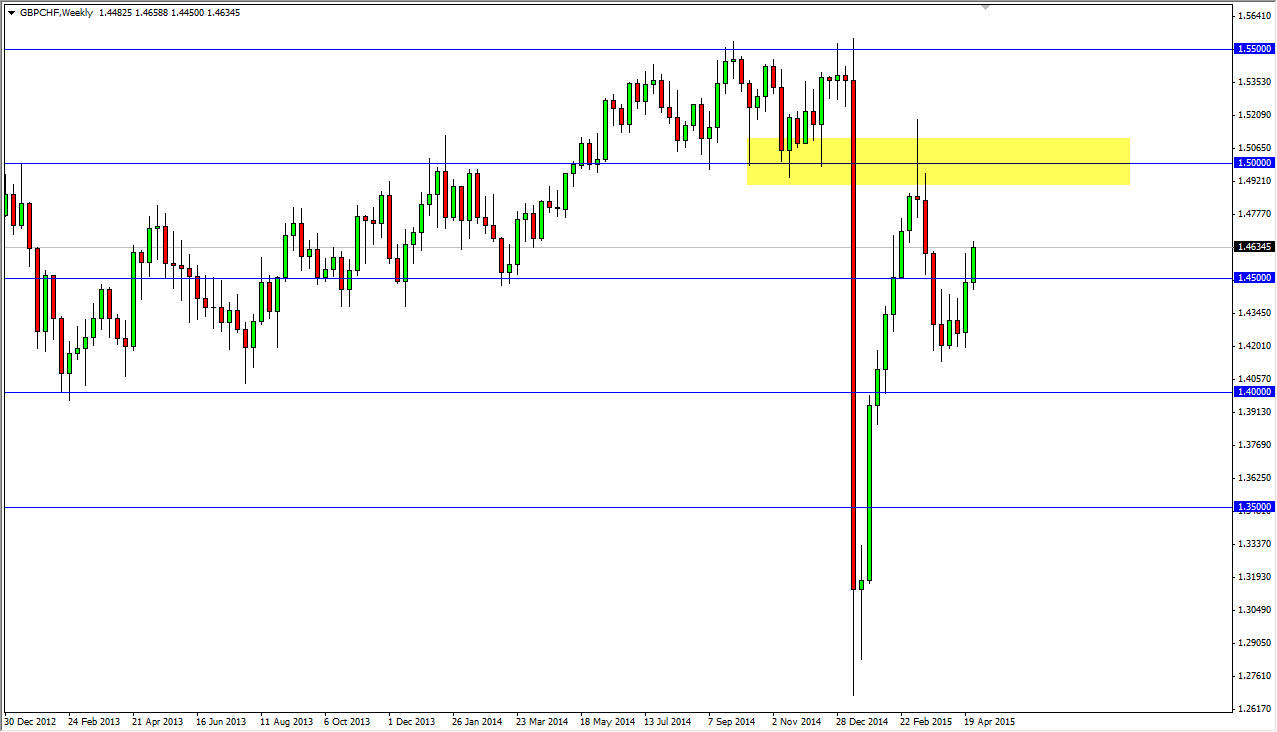

The GBP/CHF pair has had a couple of strong positive week’s recently, breaking well above the 1.45 handle. However, I am starting to see a theme in the British pound. There are levels that the British pound is going to struggle to get above, so I think that money will be made from both the up and downside of the British pound against various currencies during the month of May.

The 1.5000 level is about as big of a round number as you can find. With that being the case, it would not surprise me at all that the sellers would come in and start pushing the market back down in that general vicinity. This is why I haven’t highlighted on this chart. On top of that, we have the shooting star that formed during the last visit to this level, and of course the obvious support and resistance that the number has offered in the past.

The Swiss franc has been a bit of an interesting currency lately, as it appears we are trying to take back most of the gains from the Swiss franc that happened after the Swiss National Bank dissolved its currency peg against the Euro. However, I have to believe that most of the sell orders in the Swiss franc related pairs were more than likely public traders panicking. Because of this, it’s very likely that the real money is closer to where the candle started. The money that the Swiss National Bank had in the market for example.

That being said, I think that it’s going to be difficult to completely wipe off that candle. I’m not saying it isn’t going to happen sooner or later, just that we are going to have to make several attempts to do so. With this in mind, I believe that we have a continuation of the rally in the British pound for the first couple of weeks during May, but it’s only a matter of time before the sellers come in, and I would jump all over a resistive candle somewhere in the 1.50 level on the daily charts.