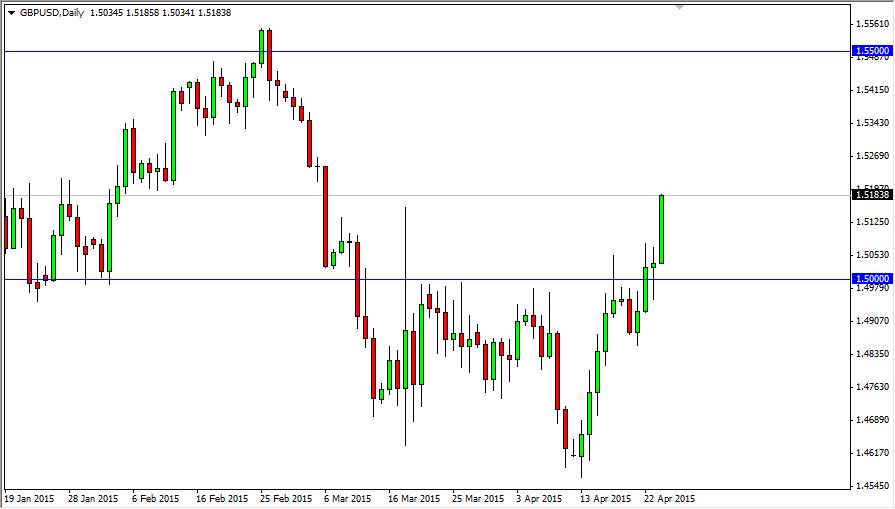

The GBP/USD pair broke much higher during the course of the session on Friday, clearing the top of the hammer that had formed on Thursday. More importantly, and broke above the top of the spike that had formed in the middle of March. In other words, we are breaking through the very last vestiges of resistance. With this, I believe that we can get above the 1.52 level, and that should send this market looking for the 1.55 handle. I think that area is going to be massively resistive, but I do believe that it’s only a matter of time before we have to test it.

There is a lot of noise between here and there, so quite frankly this isn’t going to be easy to accomplish. However, the fact that we closed at the very top of the range for the session on Friday tells me that there is quite a bit of significant pressure going forward.

British pound

The British pound seems to be a bit of an outlier at the moment, as it is doing very well against the US dollar. Truthfully, most currencies are not doing so well, but Britain seems to be on its own at the moment. I do think that the 1.55 level could keep the market a bit soft, but if we can get above there I think it now has to look like a trend change. In the meantime, it’s only a matter of time before we break out to the upside in my opinion binds I would anticipate that a lot of volatility will present itself between here and 1.55.

There is the possibility that we break down though, and if we can get below the 1.50 level I would assume that’s a very negative sign. This is especially true if we break down below the 1.49 level, as it would show a significant turn of events and momentum shift. At that point in time I would anticipate heading back down to the recent lows, but at this point in time it does look like the buyers are in control.