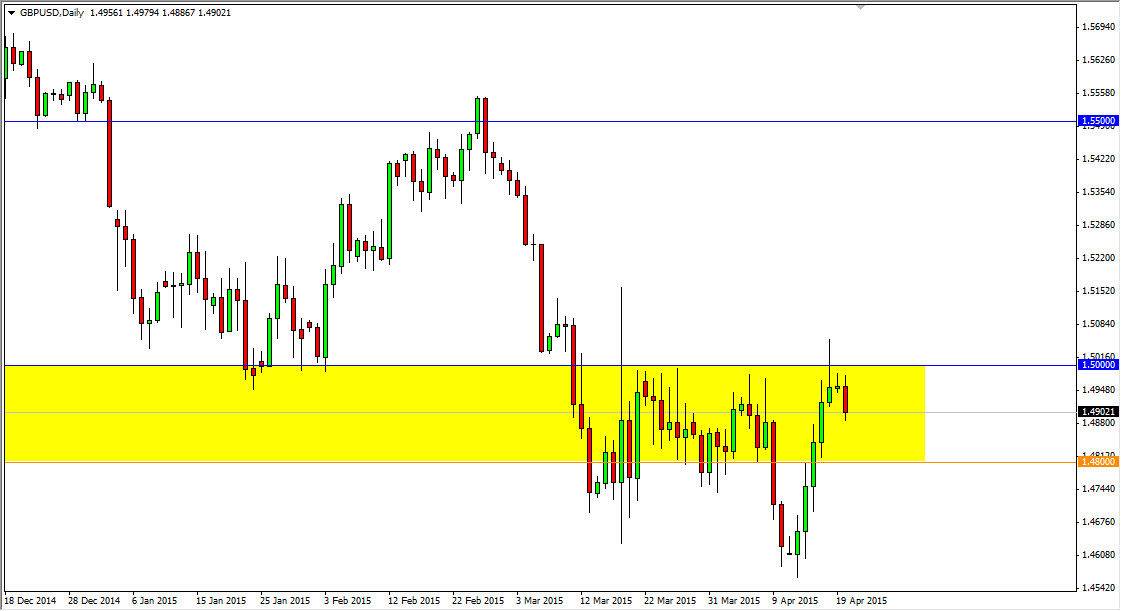

The GBP/USD pair broke down during the Monday session, breaking the bottom of the shooting star that informed on Friday. This is a very negative sign, and quite frankly I really liked where the shooting star formed, the 1.50 level. After all, it’s hard to imagine an area that’s more “round” than that level. I believe that we should continue to see what a bit of bearish pressure, but I’m not foolish enough to believe that the market will simply fall like a rock from here.

Nonetheless, I do believe that the US dollar continues to strengthen, and if the US Dollar Index is any indication, we are beginning to see that overall. I don’t necessarily dislike the British pound, I just do not think that it is going to outdo the US dollar at this point.

1.48

You can see that the 1.48 level on this chart is marked with an orange line. This is because I saw it as the beginning of significant resistance as marked by the yellow box. I think that there is even more resistance above, possibly at the 1.52 level. Because of this, it’s very difficult to imagine a scenario in which we go higher. This is especially true considering that the US dollar itself looks very healthy against most currencies overall.

I would say that the number one mistake that most traders make when they first start trading is to go against the overall trend. By trying to purchase the British pound against the US dollar, you are doing just that. Sure, it’s not that we can change trends, it’s just that it’s very unlikely. It really doesn’t happen that often if you look at the longer-term charts. Will this trend end? Of course it will. But at this point in time I don’t see anything that tells me that it’s about to change. I do recognize that the most recent action has been extremely bullish, but quite frankly this looks more or less like a “dead cat bounce” than anything else. I remain bearish.