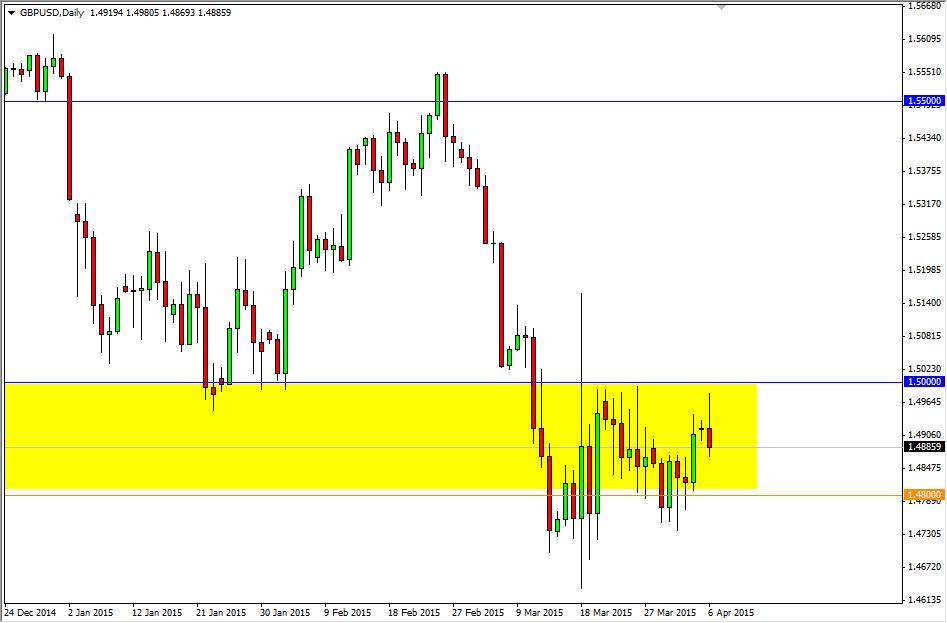

The GBP/USD pair initially rallied during the course of the day on Monday, but as you can see ran into quite a bit of resistance of the 1.50 handle. With that, I feel that falling from there makes sense as it has been significant resistance previously, and as a result ended up forming a shooting star of sorts. I believe that the 1.48 level below is going to be supportive, but it probably extends down to the 1.4750 level. Once we get below there, the market could break down and head to the 1.45 level without many issues. I think that the overall downtrend should continue, as the US dollar continues to be the favored currency around the world. However, recognize that the British pound isn’t the Euro, meaning that it could be quite a bit of volatility waiting to happen.

Selling rallies

I believe in selling rallies on short-term charts in this market, simply because the downward pressure should continue over the longer term. I don’t think that the British pound is going to suddenly collapse or anything like that, I just think that it will be a slower grind. Remember, the British are highly leveraged to the European Union, and that’s not a place you want to be invested in at the moment.

We will have to see what happens given enough time, because let’s be honest: the biggest reason for that rally was a soft jobs number out of America, which could be a “one-off.” In fact, most economists right now are starting to suggest that, and if that’s the case we should see more money flowing into the US given enough time. However, if we break out above the 1.50 level that would of course be a very bullish sign. Ultimately though, I think that it is and until we get above the 1.52 level that I’m comfortable buying. Between now and then, I feel that any rally is simply going to be value in the US dollar.