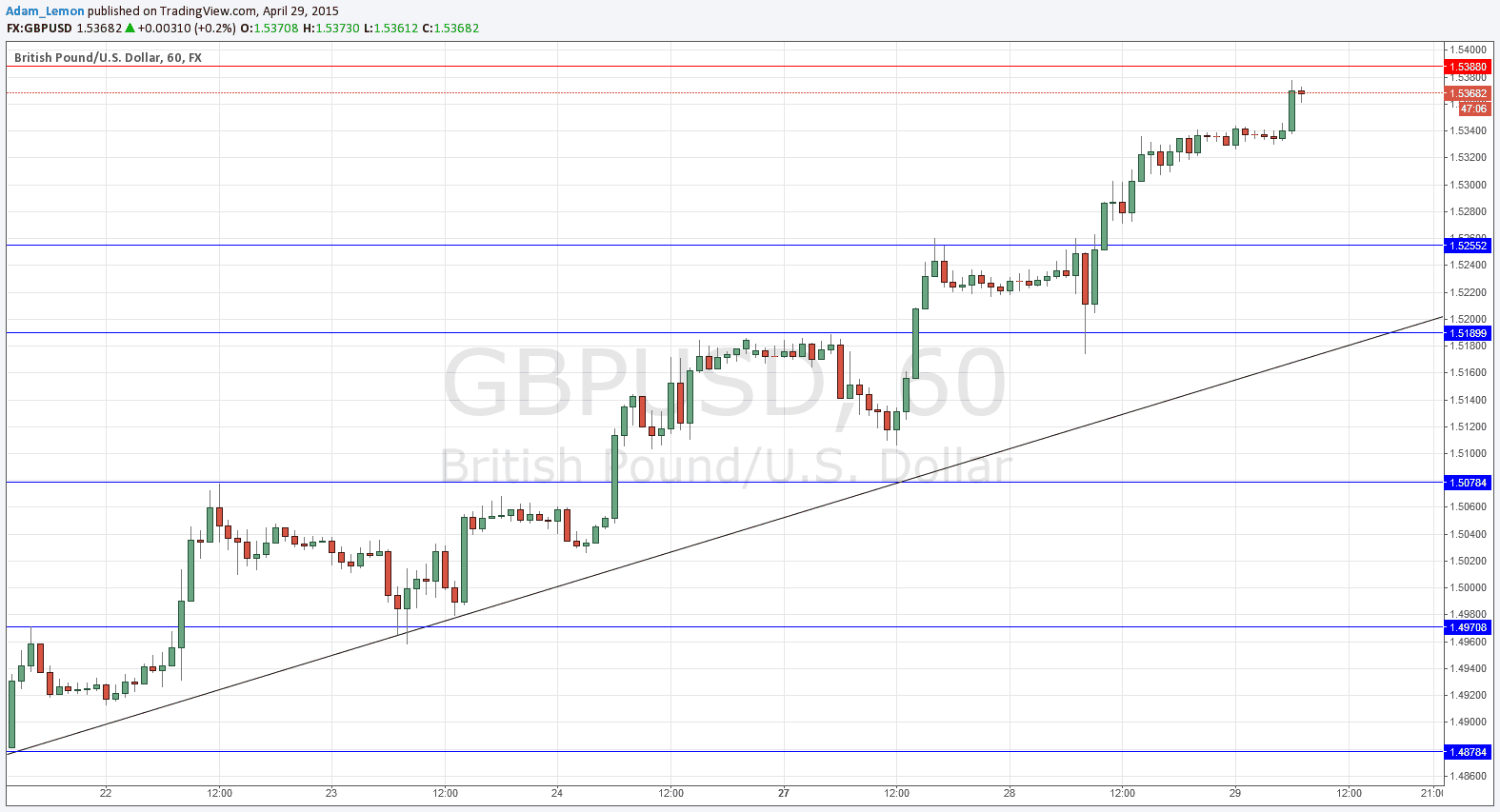

GBP/USD Signals Update

Yesterday’s signals to go long off a bullish bounce from 1.5190 was triggered and is sitting in profit now still open. It should be a good idea to take most of the remaining profit as we are close to potential key resistance.

Today’s GBP/USD Signals

Risk 0.75% per trade.

Trades must be entered before 5pm London time today.

Long Trade 1

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.5255.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 25 pips in profit.

Remove 50% of the position as profit when the price reaches 1.5288 and leave the remainder of the position to ride.

Short Trade 1

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.5388.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 25 pips in profit.

Remove 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to ride.

GBP/USD Analysis

I wrote yesterday that any news spike down would just provide a good buying opportunity and that analysis was exactly right. Poorer than expected U.K. GDP data drove the price down to the key support but it could not close below the level and bounced right back up forming a bullish engulfing bar which broke upward on the very next bar giving an opportunity to go long.

The price then easily broke past 1.5300 and is currently approaching another key resistance level.

It will probably be a quiet day now in advance of the very important USD data release that will happen after London closes today.

There are high-impact events scheduled today concerning the USD. There will be a release of Advance GDP data at 1:30pm London time, followed later at 7pm by the very important FOMC Statement and Federal Funds Rate announcement.