GBP/USD Signals Update

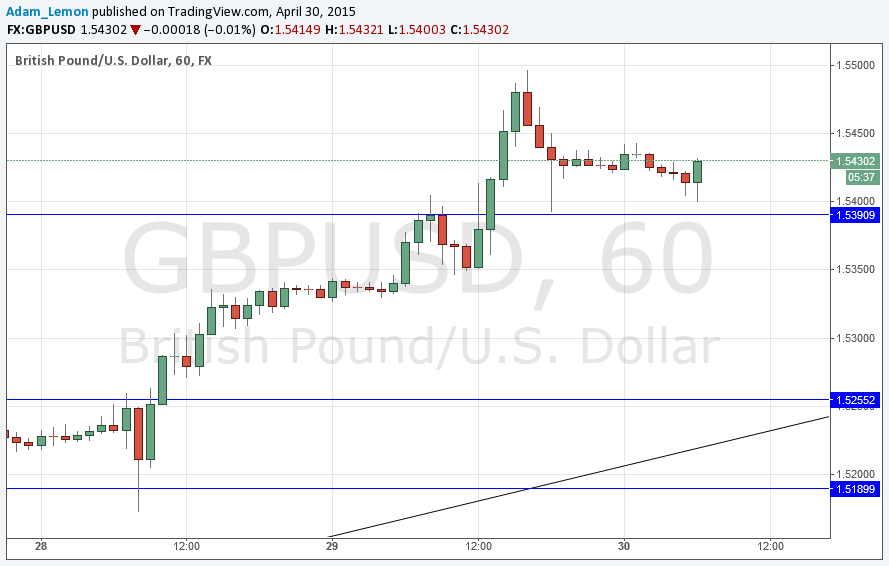

Yesterday’s signals suggested a short off bearish candlesticks at around 1.5388 which resulted in a losing trade.

Today’s GBP/USD Signals

Risk 0.75% per trade.

Trades should only be taken between 8am and 5pm London time.

Long Trade 1

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.5390.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 25 pips in profit.

Take off 50% of the position as profit when the price reaches 1.5490 and leave the remainder of the position to run.

Short Trade 1

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.5550.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 25 pips in profit.

Take off 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to run.

GBP/USD Analysis

This pair moved very bullishly yesterday following the poor USD data. That is not surprising as it is usually the leaders in the pack that do the best when there is news that only pushes in the direction of the trend.

The price went all the way up to a level just a few pips short of the key psychological level of 1.5500.

However the chart still looks bullish, and quite straightforward. The first test will be whether the level at 1.5390 holds, as if the pair remains very bullish it should have flipped from resistance to support now. Note how the level did hold initially yesterday as resistance.

There are high-impact events scheduled today concerning the USD but not the GBP. There will be a release of U.S. Unemployment Claims data at 1:30pm London time.