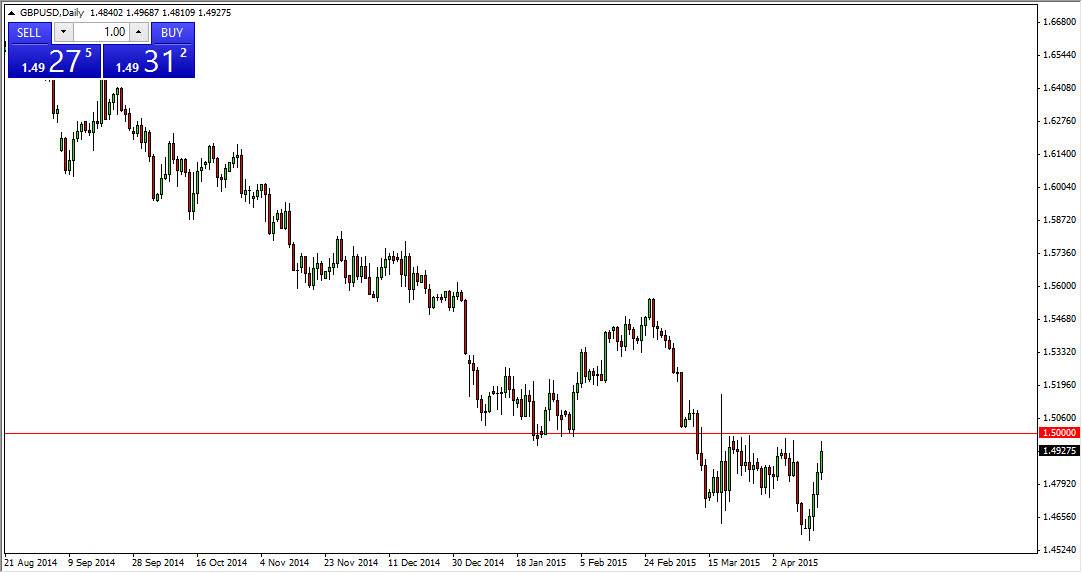

The GBP/USD pair went much higher during the course of the day on Thursday, testing the crucial 1.50 level. Because of this, looks like the market is going to test the will of the buyers soon, as this area is a massive barrier. I believe that the area that extends all the way to the 1.52 level, so I have no interest in buying in this area right now because it can be far too difficult to poke through. With that being the case, it’s very likely that the sellers will take control again and that’s essentially what I’m waiting on, a resistive candle in this general vicinity. Not only that, I feel that it’s the resistance extends all the way to the 1.52 handle, so it’s very difficult for me to imagine buying this pair anytime soon. I believe that the market will find enough resistance above to drive this pair back down to the 1.48 level, and if we get below there I think we go much lower.

Not willing to buy quite yet, perhaps we are overextended.

I believe that we are overextended in the short term even if we are going to break out at this point. Because of that, I have no interest in buying, and quite frankly if you were fortunate enough to buy this pair a couple of days ago, I applaud you. I don’t see any reason why this market should continue to go higher at this rate, and I think we will slow down. It will be interesting to see how the market interprets the information coming out today, specifically the US CPI numbers and the UK Claimant Count Change numbers. This will move this currency pair, and it could be the catalyst for this market to start falling. Ultimately, I am waiting for the resistive signal in the form of a daily candle in order to begin to start selling this pair yet again.