Gold prices climbed for a second day and settled at $1211.87 per ounce, gaining $9.69, as more disappointing U.S. economic data weighed on the dollar. The XAU/USD pair advanced to its highest level since April 7 after and the Conference Board reported that its consumer confidence index slipped to 95.2 from 101.4 and figures from the Federal Reserve Bank of Richmond revealed that the composite index for manufacturing remained negative at -3 following last month's reading of -8.

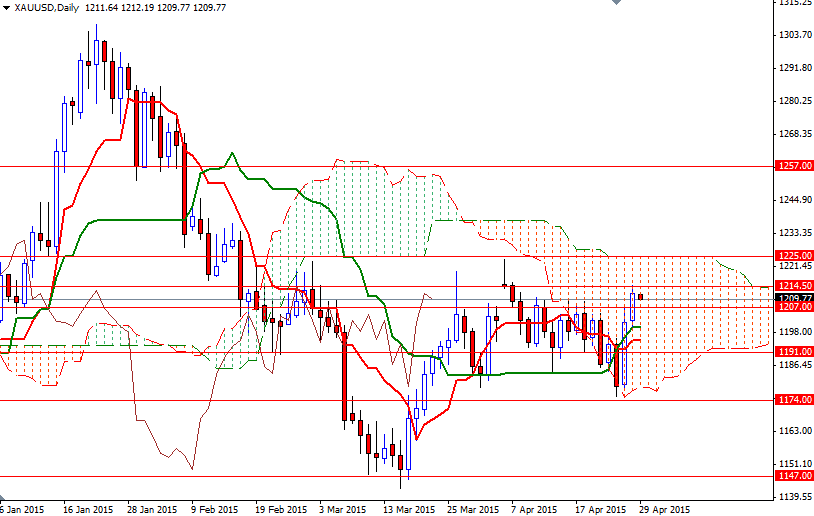

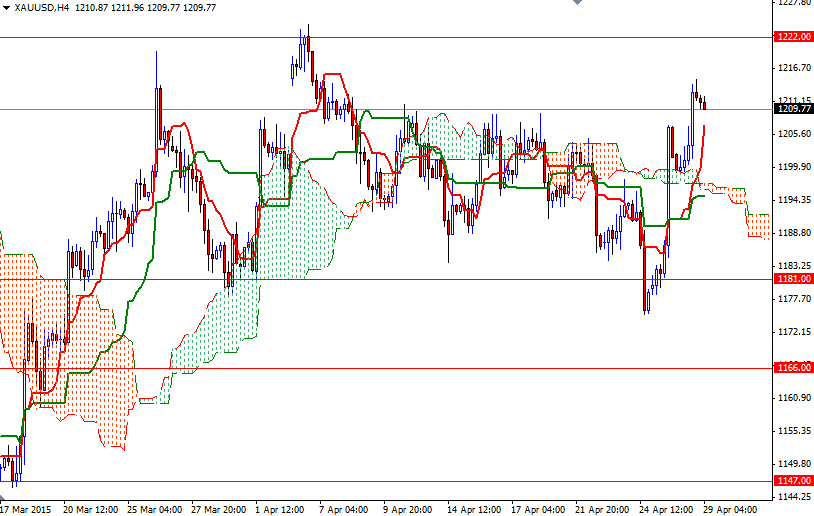

Lately, a series of soft economic data from the United States prompted investors to push back bets on the rate lift-off. Markets are awaiting the outcome of Fed's meeting but the GDP and pending home sales data which will be released earlier may create some volatility. Although trading inside the daily Ichimoku cloud suggests that the market is not out of the woods yet, the outlook on the 4-hour chart is bullish; prices are beyond the cloud and the Tenkan-sen line (nine-period moving average, red line) is above the Kijun-sen line (twenty six-day moving average, green line).

From an intra-day perspective, I will keep an eye on 1215/4 and 1207/5. If the market breaks and holds above 1215, we may see a bullish continuation targeting the 1225 level which happens to be the 50% retracement of the bearish run from 1307.47 to 1142.63. The top of the daily cloud also sits in the same area, so the bulls have to anchor somewhere above the clouds if they want to reach the 1232/3 area. However, if the bears increase the downward pressure and drag price below 1205, then the 1198/7 area will probably be the next stop. Falling through this support could push XAU/USD back to the 1193/1 region.