Gold retreated on Wednesday as investors took profits from a recent rally to a three-week high. I have to say that gold had an interesting month; the market initially advanced to the $1225/2 area then spent the next three weeks grinding lower -despite the weakness in the dollar- and rose sharply again this week. Although a recent string of downbeat U.S. economic data has stoked speculations the Federal Reserve may hold interest rates low until the third quarter or fourth quarter, policy makers don't seem to be too concerned about the recent slowdown.

In a statement after its two-day meeting, the Federal Open Market Committee said "Although growth in output and employment slowed during the first quarter, the Committee continues to expect that, with appropriate policy accommodation, economic activity will expand at a moderate pace". On the one hand we have bearish pressure from low inflation expectations, lackluster physical demand from Asia and the belief that the Fed will eventually abandon its zero-rate policy at some point but on the other hand the precious metal is finding some support due to expectations equity markets will run out of steam.

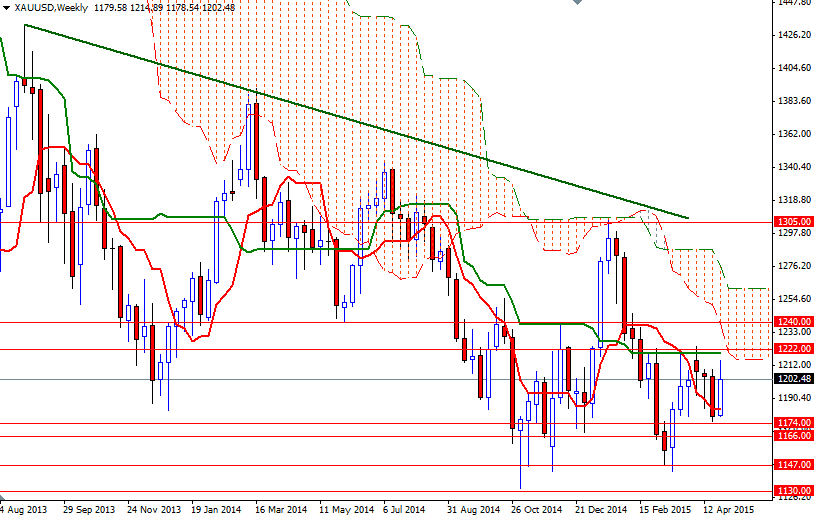

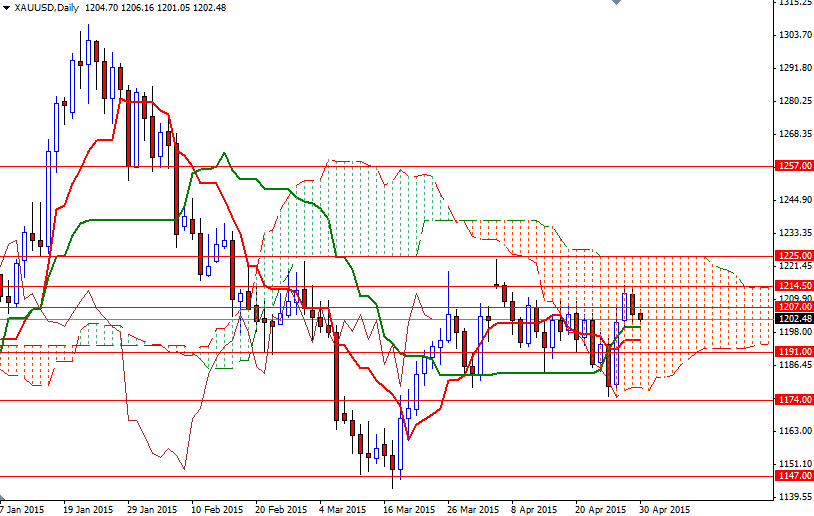

Currently the technical outlook is mixed as the weekly, daily and 4-hour charts points to different directions. Speaking strictly based on the charts, I think the XAU/USD pair will need to break either above 1225 or below 1174 (i.e. completely move out of the daily cloud) so that the market can test the next critical levels. Breaking above the 1225/2 area which has been troublesome to bulls for quite some time would imply that the market is ready to advance to the 1244/0 region. If the bulls clear this resistance, then the next stop will be the 1257 level. On the other hand, capturing the critical support at 1174 could provide the bears the power they need to tackle 1166 and push prices towards 1147/2. If XAU/USD closes below 1142, there will be little to slow down the bears' progression until 1130.