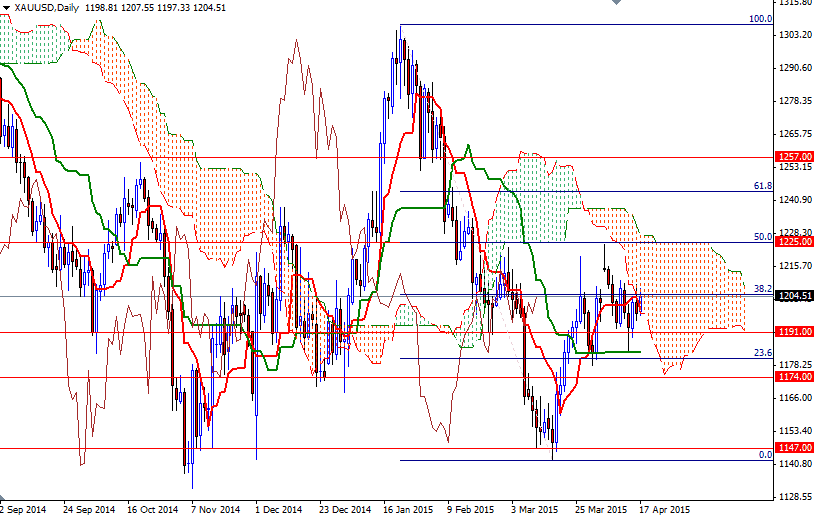

Gold started the week drifting lower, testing the daily Kijun-sen (twenty six-day moving average, green line) at one point, but recovered some of its losses as the dollar lost strength after weak economic data damped prospects of a U.S. interest rate increase as early as June. Dovish comments from Fed officials, which bolstered views that the central bank could delay normalizing policy, have helped gold in recent sessions but the uncertainty in the market has capped gains.

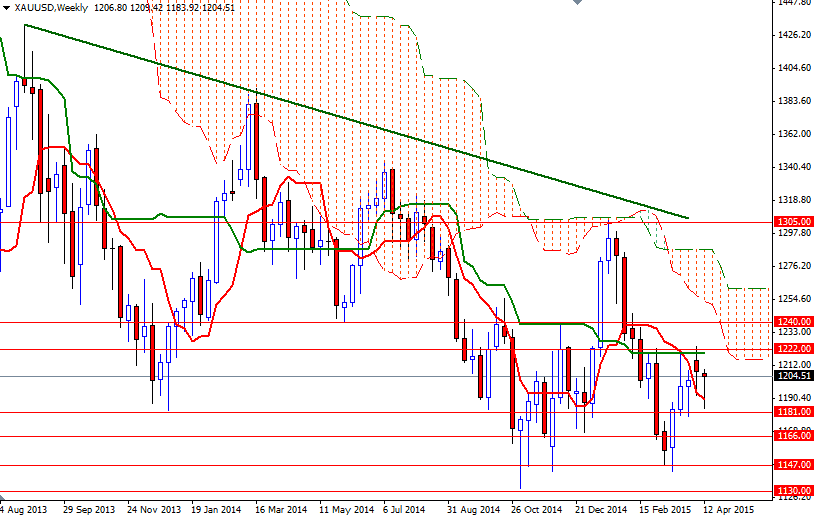

Friday's data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange reduced their net-long positions in gold to 98397 contracts from 100757 a week earlier. Pattern on the daily chart shows that gold prices will tend toward consolidation while the tall lower shadow of the weekly candle indicates the bulls are trying to hold the market above the 1183.27 - 1181 zone. As I pointed out in my previous analysis, the XAU/USD pair has to break out of the trading range that held the market captive over the last few weeks in order to gain some momentum.

In other words, XAU/USD will either break through the 1255/2 resistance and move towards the Ichimoke cloud on the weekly time frame or drop below the 1181 level and head back to the 1166 area. If the bulls successfully push prices above 1211, there is a chance we will see the market testing the 1214.50 and critical 1225/2 barriers afterwards. To the downside, initial support is currently at 1195, followed by 1191. Closing below 1191 would indicate that the bears are getting ready to challenge the 1183.27 - 1181 support zone.