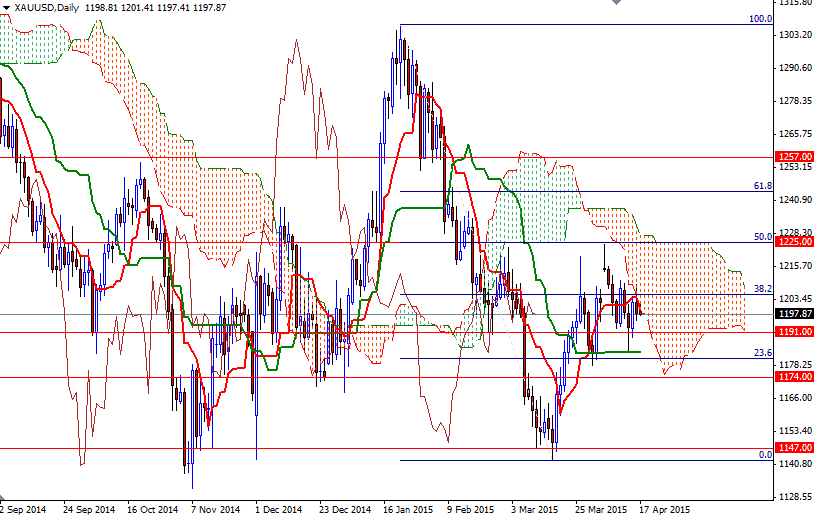

Gold prices initially rose during the course of the day on Thursday, but the market found resistance around the $1209 level and retreated to support at $1197. Despite a combination of supportive factors, including concerns over Greece's debt problems and soft U.S. data which pushed market expectations on the Fed's rate lift-off from June to September, stagnant physical demand for gold continues to weigh on the market. The dominant up-trend in equities is another element working against the precious metal.

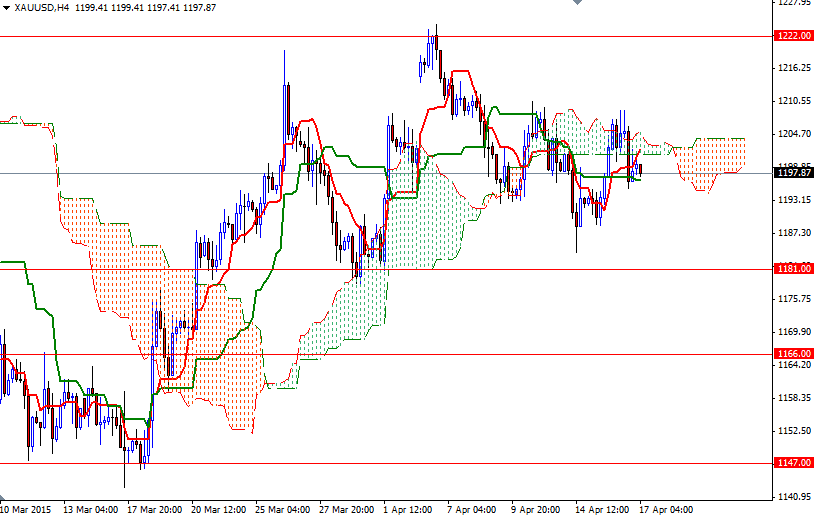

It seems that gold prices will keep oscillating around the 1200 level while the 1222 and 1181 levels contain the market. The XAU/USD pair is still trading below the weekly and daily Ichimoku clouds, suggesting that the downside risks remain. From an intra-day perspective, I think the key levels to watch will be 1195 and 1205.

The bulls will need to defend the 1195 support level and penetrate the barrier at 1205 so that they can have another chance to march towards the 1214.50 - 1211 region. Only a daily close above the 1214.50 level would lure some investors back to the market and increase the possibility of a bullish attempt to test the 1225/2 resistance zone. However, if the bears increase the downward pressure and capture the 1195 support level, then the XAU/USD pair will probably test 1191 afterwards. Breaching this support would indicate that the next stop will be the 1183.27 - 1181 area.