Gold settled up $6.27 at $1202.34 on Tuesday, helped by safe-haven bids over concerns that Greece will be unable to make all of the required payments and ultimately default on its debt, but remained within the trading range of the past 9 sessions. The XAU/USD pair traded as high as $1203.28 an ounce during today's Asian session before pulling back to the current level. Although recent signs of weakness in the U.S. economy have prompted market players to push back their bets for the first interest rate hike by the Federal Reserve, firm equity markets continue to erode demand for haven assets including gold.

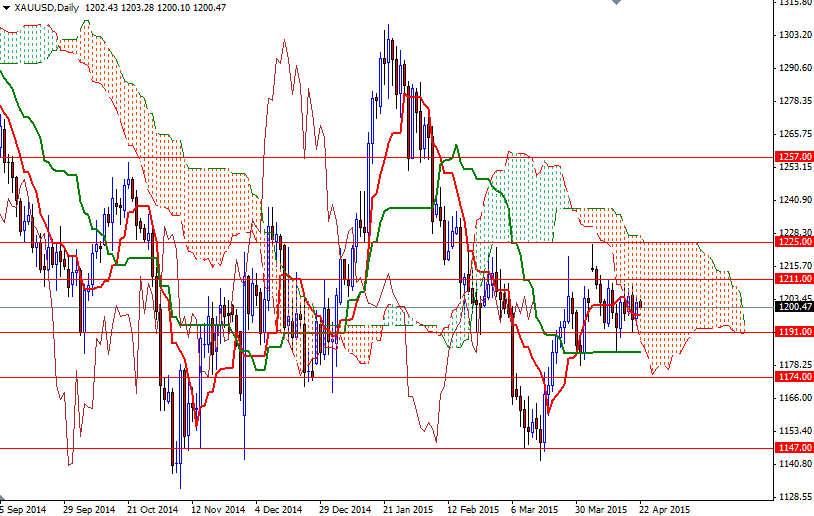

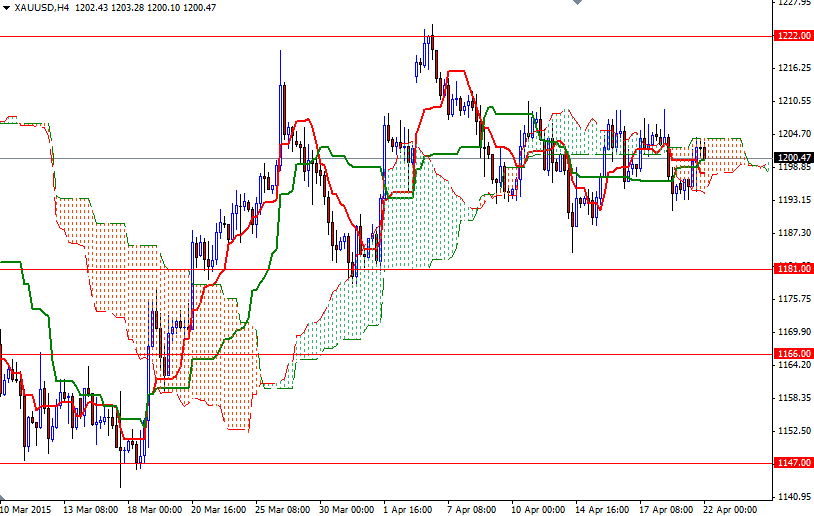

Prices have been bouncing between 1211 and 1191 as the market lack a strong catalyst to break out either way. This narrow trading range seems to be boring but eventually the market will soon reach a point where it will have to break one way or the other. Trading within the boundaries of the Ichimoku clouds on the daily and 4-hour charts also confirms that XAU/USD is looking for a direction.

From an intra-day perspective, the first hurdle gold needs to jump is located around the 1205 level. I think penetrating this level could give the bulls the extra power they need to visit 1211 and 1214.50. Closing above 1214.50 would make me think that XAU/USD is on its way to test the 1225/2 resistance zone. There has been a significant amount of resistance around the 1225 level ((50% retracement of the decline from 1142.63 to 1307.47) so breaking through this barrier will be essential for a bullish continuation. To the downside, support may be found at 1195, followed by 1191. Only a break below the 1191 level could increase downward pressure. In that case, 1181 and 1174 will be the next possible targets for the bears to capture.