Gold prices fell $7.97 an ounce yesterday, down for the fourth straight session to $1194.62, as expectations the Federal Reserve would begin to increase interest rates in June continued to weigh on the market. In economic news on Thursday, the Labor Department's data showed initial claims for state unemployment benefits remained below 300K threshold for the fifth straight week. Gold has come under renewed pressure in recent days, after Fed officials said they could being raising rates even if inflation remains stuck at a low level.

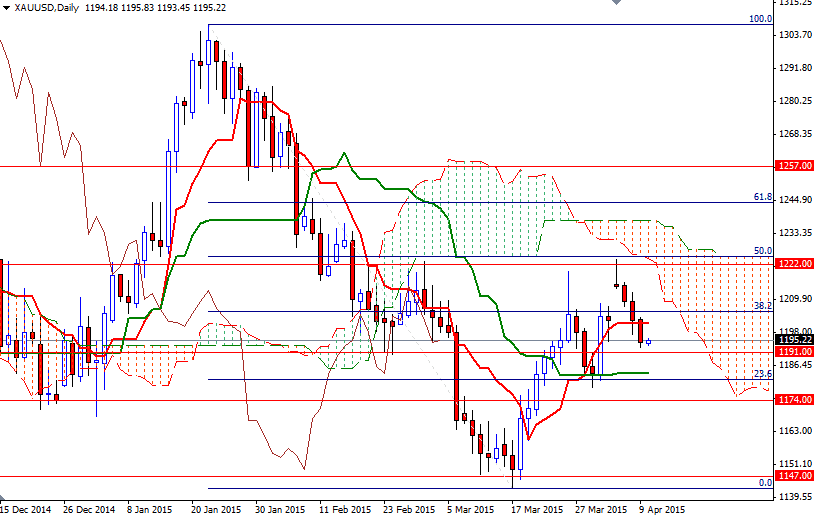

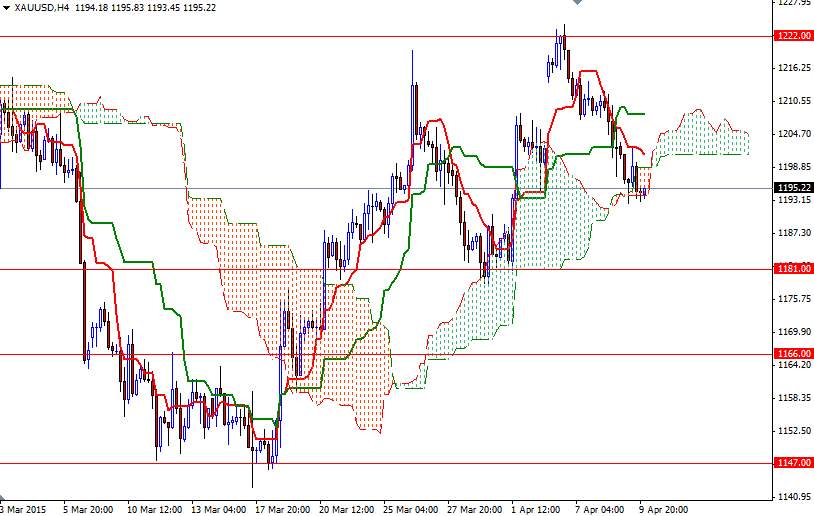

Breaking below the 1198 level dragged the market to the 1193/1 area, where the Ichimoku cloud reside on the 4-hour time frame, as expected. As I mentioned in yesterday's analysis, this is a key support that the bears have to capture if they intend to increase selling pressure and make an assault on the 1183.27 - 1181 region. Since the daily Kijun-sen (twenty six-day moving average, green line) and Fibonacci 23.6 converge in the same area, shattering this floor could lure more sellers into the market and increase the possibility of a bearish attempt to revisit the 1174 and 1166 levels.

However, if the Ichimoku clouds (4-hour chart) continue offering support, expect a bounce towards 1205.30 - 1202. Beyond that the next challenge will be waiting the bulls around the 1208 - 1210 level. It is quite possible that the XAU/USD pair will gain some traction and approach the daily cloud if it can push through that strategic area.