Gold ended higher on Thursday, recouping some of yesterday's losses, as disappointing U.S. economic data pressured the dollar. The greenback weakened after the Commerce Department reported sales of new homes tumbled 11.4% to an annual rate of 481000 in March, well below expectations of 514000, and Markit said that its flash manufacturing purchasing managers’ index fell to 54.2 in April from 55.7 in March. The XAU/USD pair traded as high as $1197.95 an ounce before pulling back to the $1193 level.

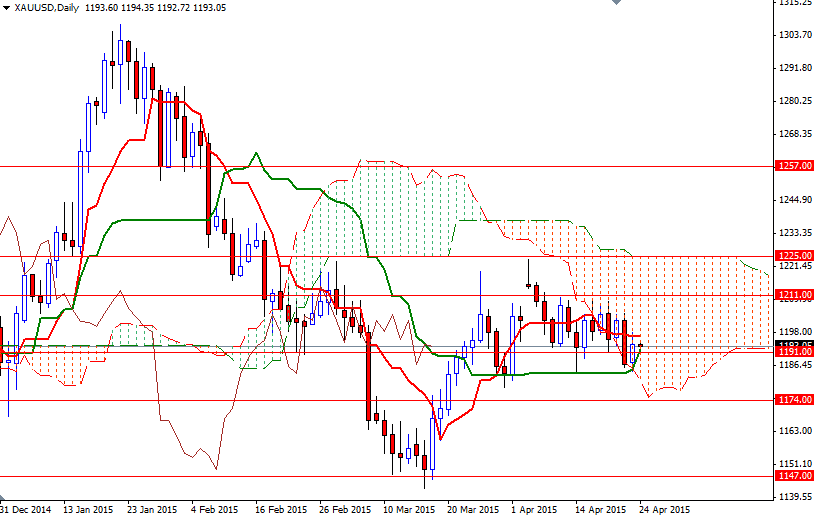

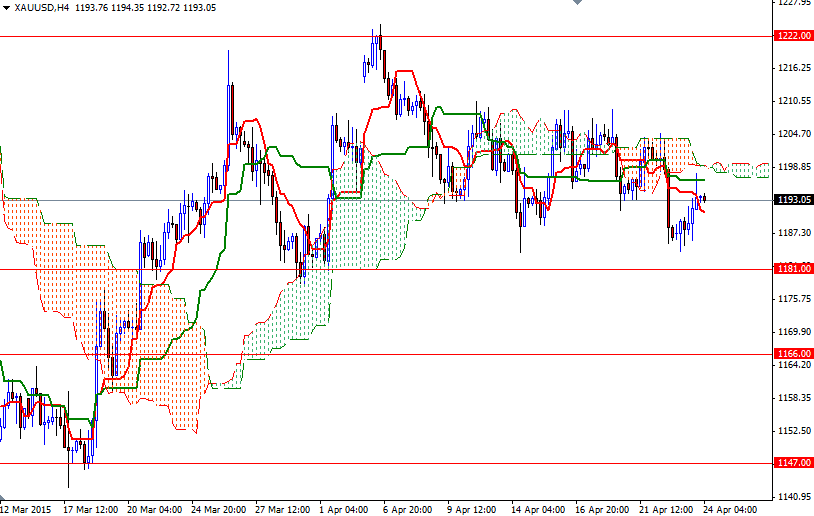

Apparently the support in the 1184/1 region also helped market revisit the resistance around 1195, a scenario which I pointed out yesterday. Technically, the odds favor further downside as long as the market remains below the weekly Ichimoku cloud. Trading below the cloud and bearish Tenkan-Sen (nine-period moving average, red line) - Kijun-Sen (twenty six-day moving average, green line) cross on the 4-hour time frame also support this theory.

However, prices are moving inside the daily cloud at the moment and it suggests a range-bound movement. Until we anchor somewhere above the Ichimoku clouds, there will not be any real technical reason to buy gold. On the upside, the key levels to watch are 1200 and 1205. The bulls will have to shatter this critical resistance so that they can challenge the bears on the next battlefield, the 1211 level. Closing beyond 1211 means XAU/USD will possibly test the next barriers at 1214.50 and 1225. On the other hand, If the bulls fail and prices reverse, support to the downside can be found at 1191 and 1188. Dropping below 1188 would indicate that the bears are getting ready to tackle the 1184/1 support.