Gold continued to retreat from a seven-week high struck this week, gains in the U.S. dollar and global equities helped push the metal down another $5.6 to $1209. Gold market is understandably calm during the Asian session today. It seems that market participants opt to remain on the sidelines ahead of the release of the minutes from the Federal Reserve's March 17-18 policy meeting. These records could provide insight into Fed officials' discussion on when to hike rates from current rock-bottom levels.

While some believe that last week's bleak jobs report will give the Fed less confidence that the economy is strong enough to endure higher interest rates, I don't think that a single report will really alter their plans. However, until economic data improves and confirms that softness was indeed caused by bad weather, the market may price in a very subdued pace of the tightening cycle.

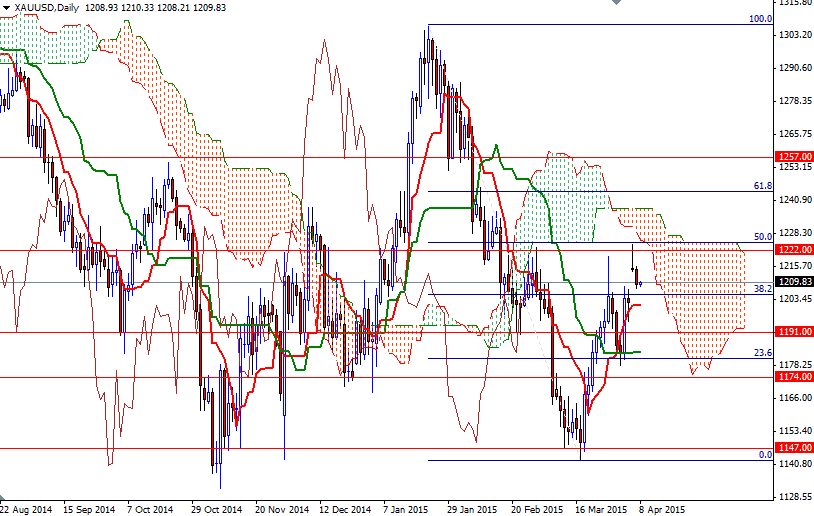

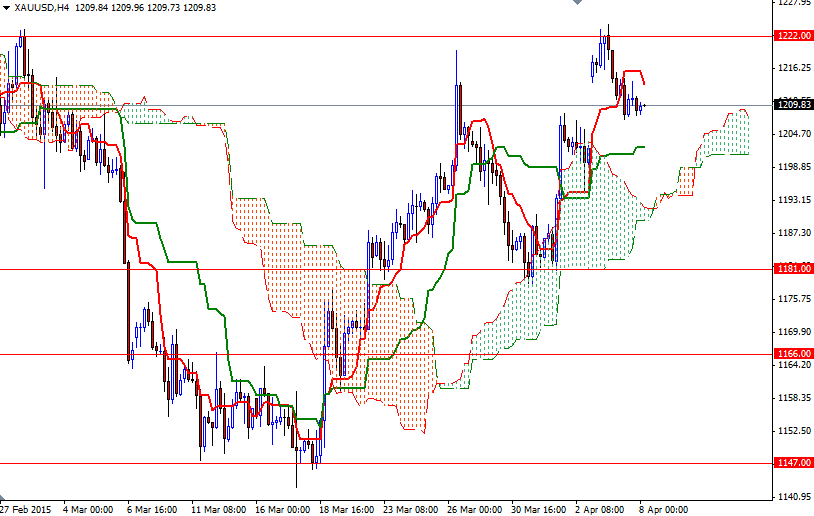

The XAU/USD pair is currently hovering just above the support around the 1209 area and there are a bunch of supports between here and 1198. If the market breaks below yesterday's low, then we may see the pair testing the 1205 (Fibonacci 38.2 based on the distance between 1307.47 and 1142.63) and 1201 (daily Tenkan-Sen) levels. Closing below 1198 on a daily basis could encourage sellers and increase the possibility of an attempt to reach the 1191 support. Initial resistance is located around the 1216.45 level which happens to be the top of the hourly Ichimoku cloud. If prices break and manage to hold above that barrier, we could see the pair extending its gains and heading towards the 1225/2 area.