Gold prices ended Wednesday's session up 0.83% at $1202.39 per ounce as weakness in the greenback lured some investors back into the market and helped prices regain their footing. The XAU/USD pair traded as low as $1188.70 but found support around these levels and reversed after economic data out of the U.S. came out well below forecasts. According to figures from the Federal Reserve, industrial output fell 0.6% in March and manufacturing activity in the New York region dropped to -1.2 from 6.9 a month earlier.

A recent string of disappointing data has sparked speculation that the Fed will push back its timetable for raising interest rates. Apparently, gold will be supported over the near term while investors see diminished likelihood of a mid-year rate increase but for the long term the market will continue to suffer unless a serious financial or geopolitical instability threatens to drag stock markets around the world into a death spiral.

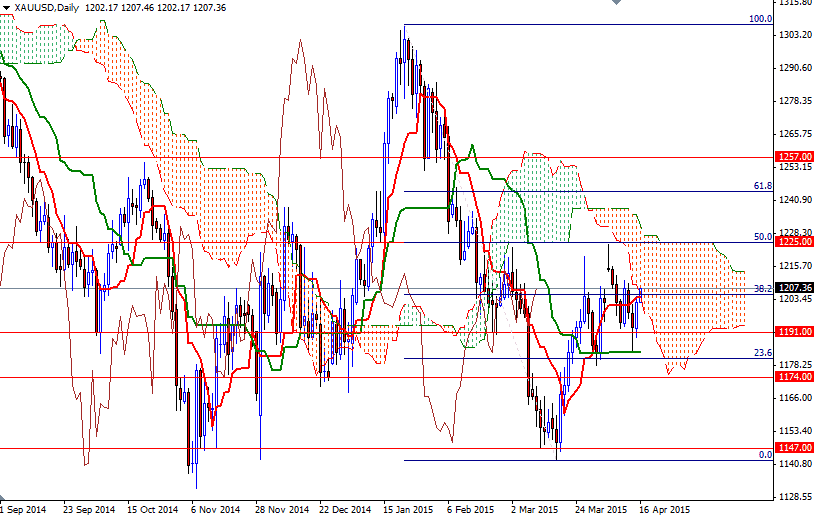

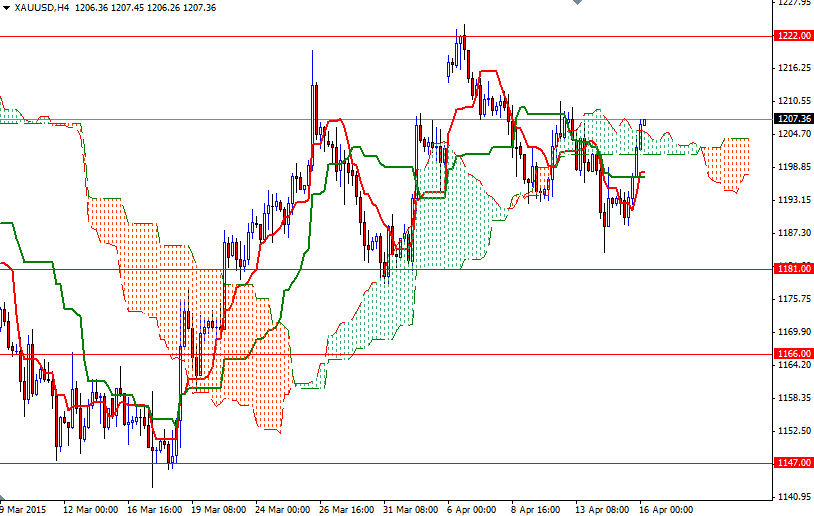

Although the market is currently trading above the Ichimoku cloud on the 4-hour time frame, the daily cloud is right on top of us. These clouds not only identify the trend but also define support and resistance zones. Basically, the overall trend is up when prices are above the cloud, down when prices are below the cloud and flat when they are in the cloud itself. The thickness of the cloud is also relevant, as it is more difficult for prices to break through a thick cloud than a thin cloud. That means if the bulls intend to stay in the game, they will have to push the market beyond the 1214.50 - 1211 area first. Technically, breaking above this barrier would signal a run up to 1225/2. To the downside, initial supports are located at 1197 and 1193/1. If the support around 1193/1 is broken, then XAU/USD will probably pull back towards the 1183.27 - 1181 zone again.