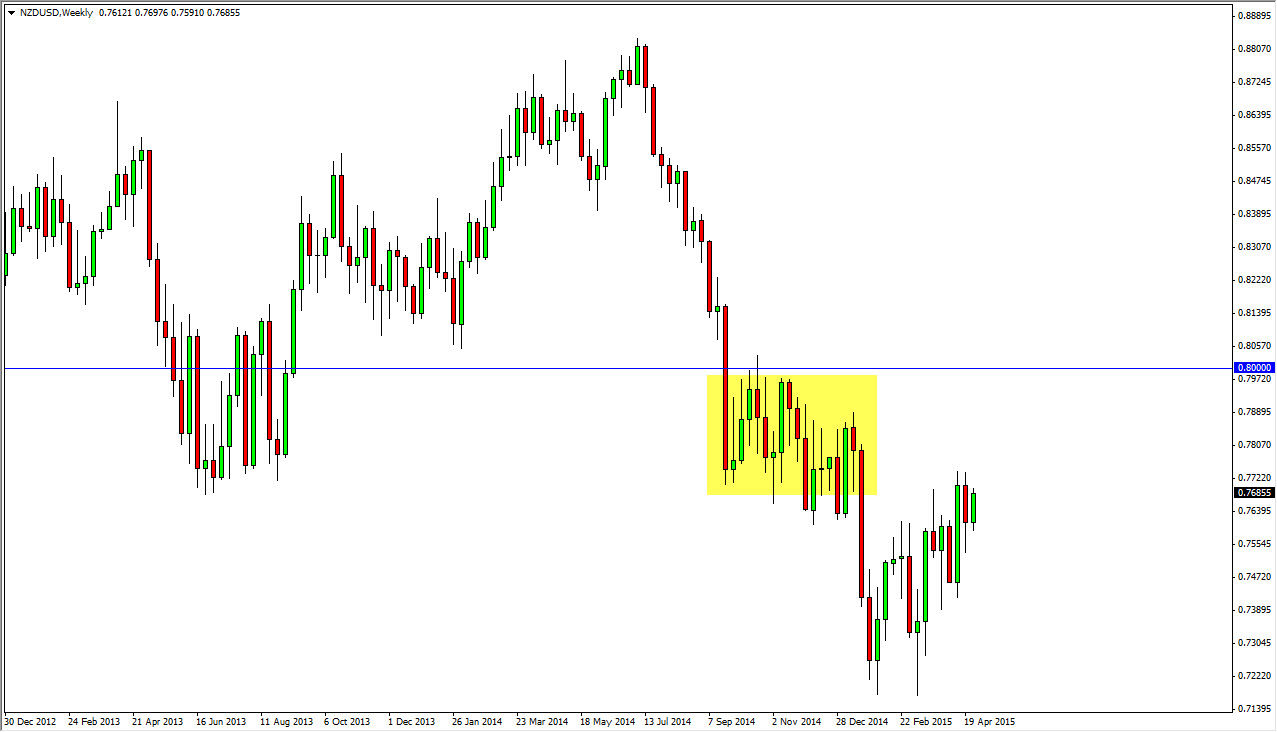

The NZD/USD pair has been grinding away to the upside for several weeks now. It’s been a real fight, but the New Zealand dollar has risen from the 0.72 level to the 0.77 level at the time of writing. However, I see a massive cluster of resistance just above, and I see it extending all the way to the 0.80 handle. Because of this, I believe that it’s only a matter of time before the New Zealand dollar starts to sell off again, and I will be looking for resistive candles, perhaps on the daily charts.

The commodity markets have gotten a little bit of a boost towards the back half of April, but I do not believe that can continue for much longer. After all, there just simply isn’t enough global growth to fuel demand for most commodities right now. With that in mind, I believe that the New Zealand dollar will suffer simply because it is such a commodity sensitive currency. I believe that the 0.80 level is a significant barrier, and it’s not until we get well above there that I would consider buying this pair.

Granted, the US dollar has taken it on the chin the last couple of weeks, but quite frankly when you look at the trends in the currency markets, nothing has really changed. The market has simply bounced slightly, and hasn’t been that impressive doing so. With this, I believe that if you are patient enough you will get an opportunity to sell the New Zealand dollar again, and probably make quite a bit of money in the process.

I do recognize that if we get above the 0.80 level than we have to start looking at other forms of resistance above, but I think back psychological barrier being broken would have a bit of an effect on the marketplace longer-term. At that point in time I would anticipate that the markets probably going to try to go back to the 0.88 handle, but certainly wouldn’t do so quickly. It becomes more of a “buy-and-hold” type of market at that point.