USD/CAD Signal Update

Yesterday’s signals expired without being triggered as although both the levels were hit there was no appropriate price action when either level was reached justifying an entry.

Today’s USD/CAD Signals

Risk 0.75% per trade.

Trades may only be entered today between 8am and 5pm New York time.

Long Trade 1

• Go long after bullish price action on the H1 time frame immediately following the first test of 1.2520.

• Place the stop loss 1 pip below the local swing low.

• Move the stop loss to break even once the trade is 20 pips in profit.

• Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

• Go short after bearish price action on the H4 time frame provided there have been no hourly candle closes above 1.2575 and the candlesticks are showing a bearish reversal, and the price has not fallen too far from that resistant level.

• Place the stop loss 1 pip above the local swing high.

• Move the stop loss to break even once the trade is 20 pips in profit.

• Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

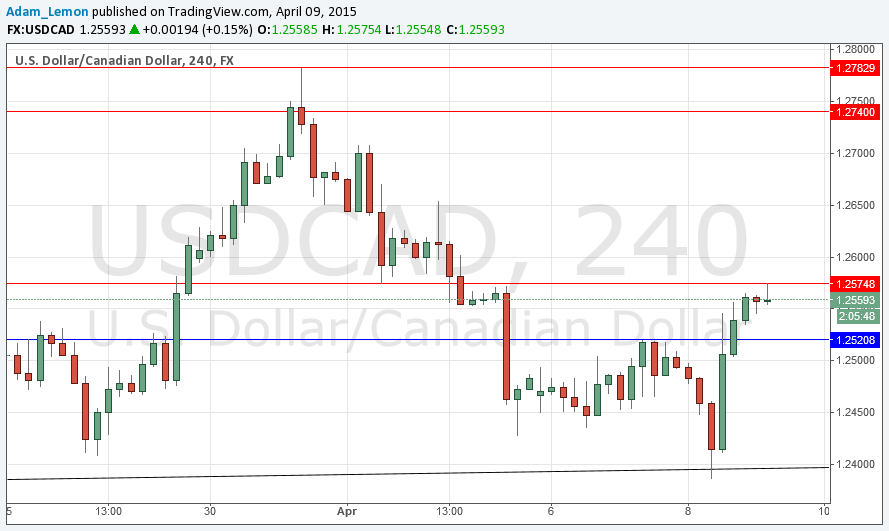

USD/CAD Analysis

Yesterday I was looking at the bullish trend line at about 1.2430 to provide key support. Unfortunately the trend line was quite ambiguous, so although it looked as if it had broken bearishly, support actually kicked in below 1.2400 and the line can now be re-drawn to accommodate that. The area at around 1.2400 has continued to provide support for this pair for quite a long time now. Following last night’s FOMC release, the price moved up fairly strongly to hit anticipated resistance at 1.2550. However there was no bearish price action there and the price continued to move up higher. At the time of writing, the price is hitting a resistance level at 1.2575 and is showing signs of turning and reversing bearishly. This could be a good short trade but should be taken only with a 4 hour candle reversal instead of the usual 1 hour, as there has been very strong bullish momentum following a major news release.

There are high-impact events scheduled today concerning both the CAD and the USD. At 1:30pm London time there will be releases of Canadian Building Permits and US Unemployment Claims data.