USD/CAD Signal Update

Last Thursday’s signal was not triggered as the price did not return to 1.2370.

Today’s USD/CAD Signals

Risk 0.75% per trade.

Trades may only be entered today between 8am and 5pm New York time.

Short Trade 1

Go short after bearish price action on the H4 time frame immediately following the next test of 1.2250.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 2

Go short after bearish price action on the H4 time frame immediately following the first test of the area between 1.2365 and 1.2400.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 1

Go long after bullish price action on the H4 time frame immediately following the first test of 1.2050.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride

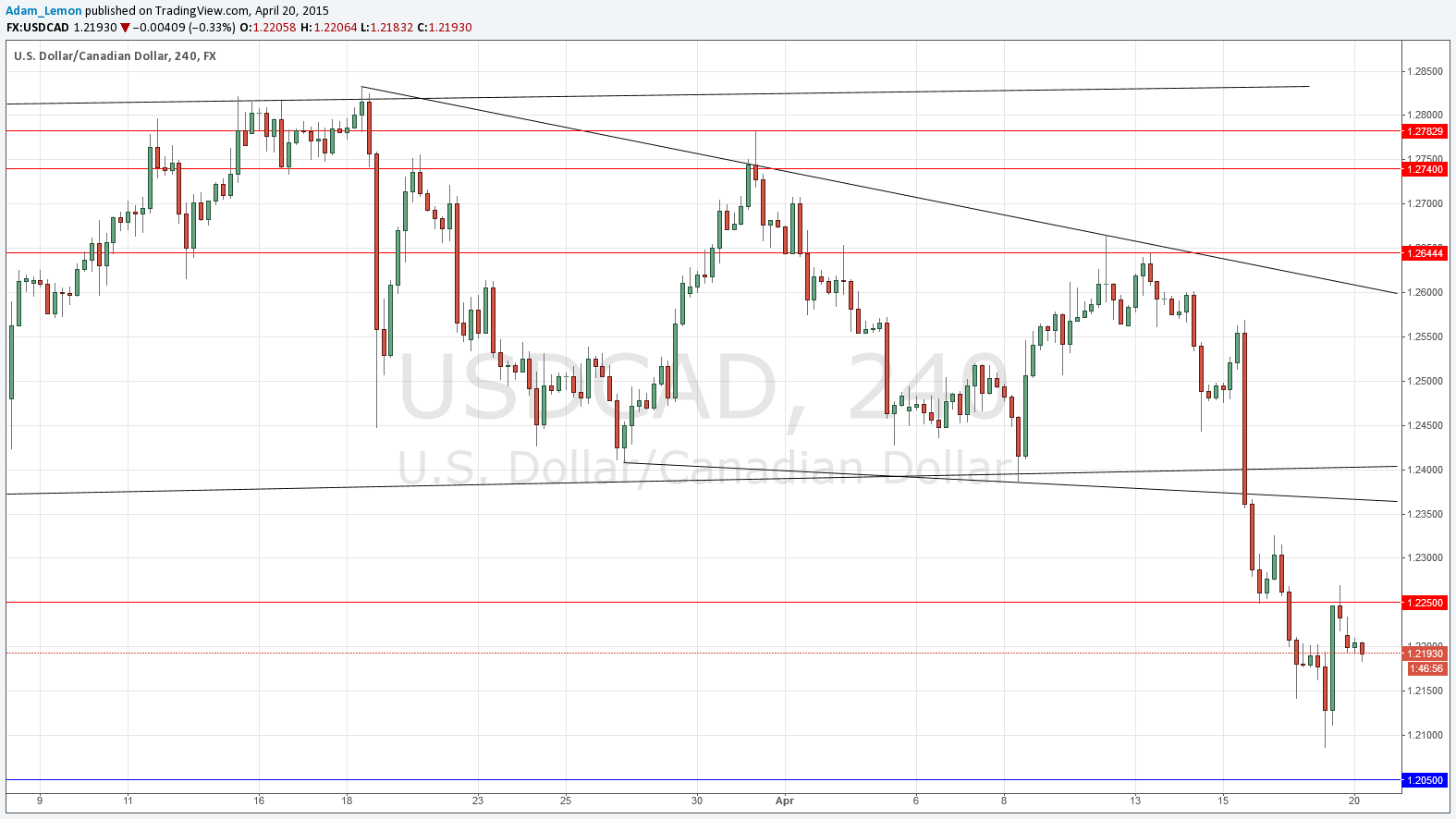

USD/CAD Analysis

The price continued to fall very sharply, coming close to the anticipated support level at 1.2050 where it turned and rose sharply by about 200 pips. Since then the price has been falling off and volatility is normalising.

Another failed test of 1.2250 should give another opportunity to get short. It seems likely we will reach this level before we get to the support at 1.2050, where there should be another long bounce.

This pair has been a big mover in the market and should provide some nice trades in the near future.

There are high-impact events scheduled today concerning the CAD but not the USD. At 3:05pm London time the Governor of the Bank of Canada will be speaking at a conference.