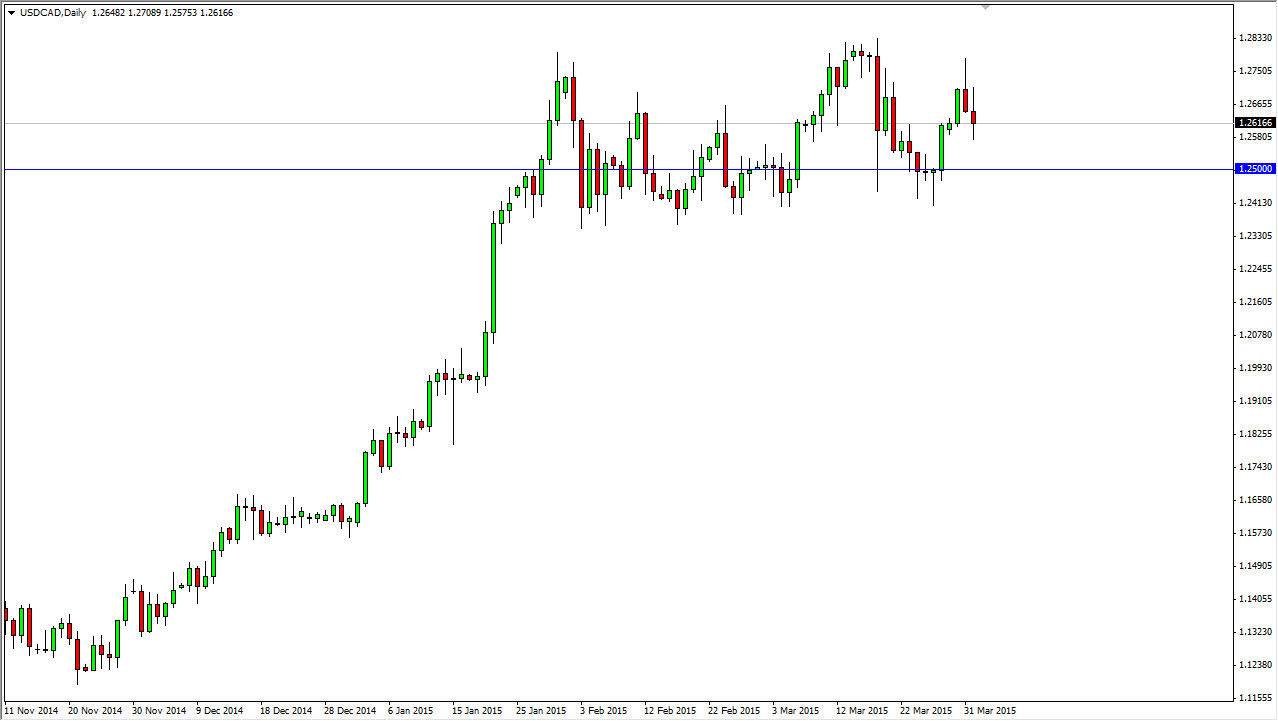

The USD/CAD pair went back and forth during the course of the day on Wednesday, ultimately settling on a relatively neutral candle. With that being the case, it looks as if the market is ready to continue dropping a bit, but it won’t necessarily be the easiest thing for it to do. After all, the US dollar is without a doubt the favored currency around the world, while the Canadian dollar languishes. The oil markets certainly won’t do any favors for the Canadian dollar either, so ultimately I believe that this market will go higher.

I think that the 1.24 level below is the “bottom” of the consolidation area that we have been in for some time, and that anytime we go near that area a supportive candle is an excuse to start buying. I think that the “top” of the consolidation area is near the 1.28 handle, so I down to that the markets will get above there easily. However, keep in mind that the Nonfarm Payroll numbers come out on Friday, and this pair tends to be very susceptible to volatility during those announcements.

Buying pullbacks

I have been buying pullbacks in this pair for some time now, aiming for short-term gains. I believe that short-term charts could be used for entrance to this market, but longer-term traders will without a doubt remain stymied. At the end of the day though, I believe that this market will eventually break out and test the 1.30 level, which is what kept the market down during the financial crisis. If we can get above there, the suddenly becomes a buy-and-hold situation. However, is going to take a significant amount of momentum to break out above there, so I think it will be more consolidation in the near term. This could be an excuse to build up momentum, but at this point in time it’s difficult to imagine that it’s going to be an easy thing to do. On the other hand, the US dollar shows absolutely no signs of letting up.