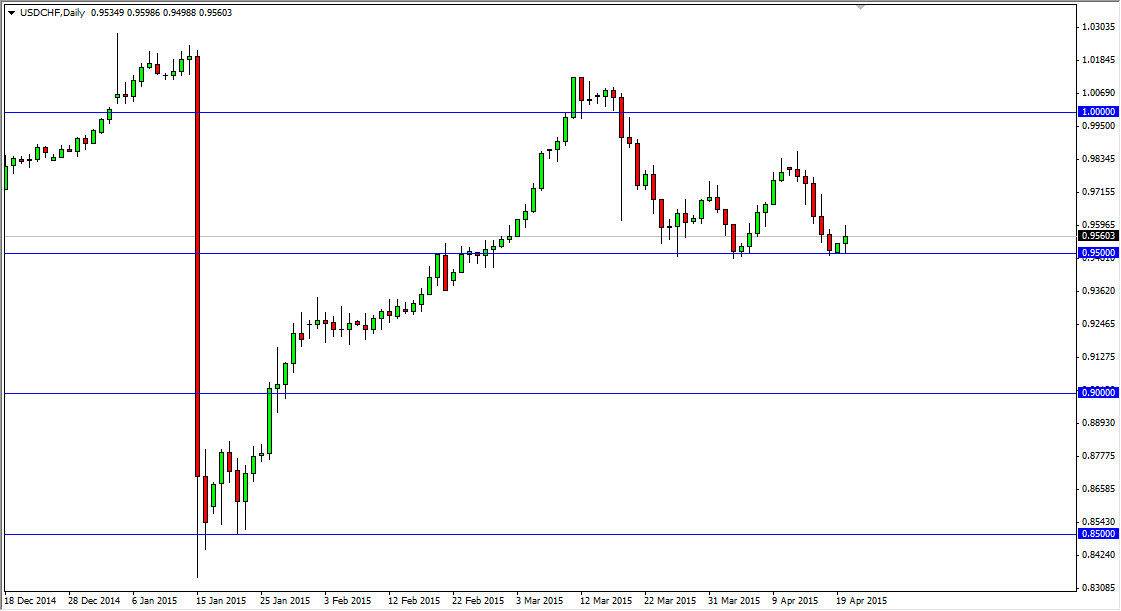

The USD/CHF pair showed a significant amount of support at the 0.95 handle again on Monday, as we simply open there and bounced around only to form a relatively positive candle. Quite frankly, I believe that the 0.95 level is a bit of a “floor” in this marketplace, so I would not anticipate the market going lower from here. If we did, I am not actually willing to sell this unless we get below the 0.94 handle, and we start to see the US dollar selloff around the world. At this moment in time, that looks very unlikely, so I believe that this pair is going to go higher, perhaps as high as the 0.95 zero level over the course of the next couple of sessions.

I believe that a break above the top of the range is the buying opportunity that we are looking for, or perhaps some type pullback closer to the 0.95 level that show signs of support on a short-term chart. Either way, I do not like selling the US dollar.

Switzerland’s problem is simple geography

Switzerland’s biggest problem is that it stuck in the center of Europe. Quite frankly, it’s not the Swiss that everybody’s worried about, rather the European Union. Unfortunately for the Swiss, the country sends 85% of its goods into the European Union, which of course has a multitude of issues. By its very location, the Swiss are going to have problems due to the fact that the Europeans can’t seem to get it together. Deflationary concerns with your largest customer of course does nothing for business either.

The Euro continues to fall, and although this pushes up the value of the Swiss franc, quite frankly most people are not willing to have money on the continent at all. Think of it this way: where would you rather put your money? A New York bank, or one in Zürich? At this point time, the world seems to be picking New York. With that, I believe that a break above the top of the range or the supportive candle that I mentioned previously are both buying opportunities. Ultimately, I think we wipe out the entire selloff that we saw when the Swiss National Bank lifted its currency peg against the Euro.