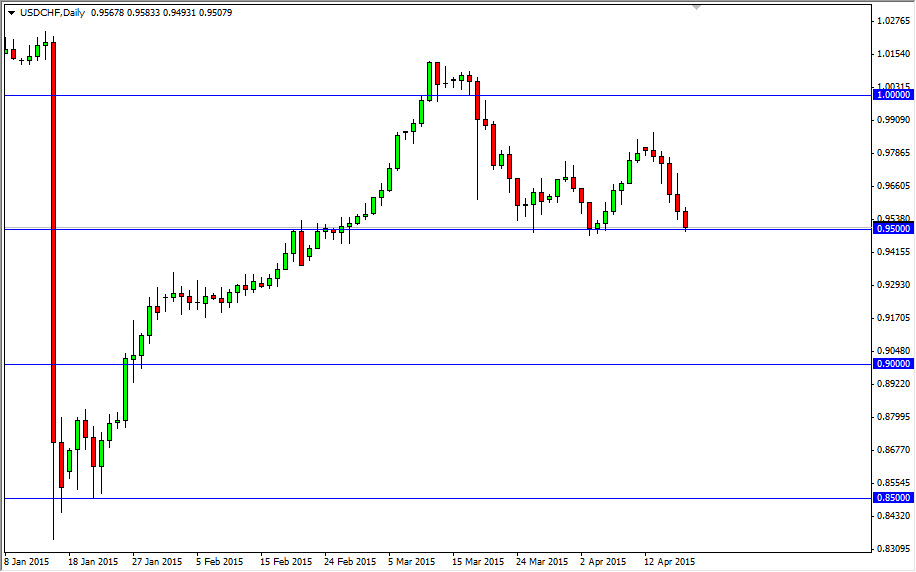

Looking at the USD/CHF pair, you can see that we fell significantly during the session on Friday. Importantly though, we found the 0.95 level to be supportive enough to keep the market supported and buyers stepping in. With this, the market looks as if it is testing this area significantly and decide whether or not we could go much lower or whether or not we can find a supportive candle to start buying. If we break down below the 0.94 level, I feel that the market would then head to the 0.90 level. On the other hand, if we get a supportive candle in this region, I believe this market will then turn things back around and head to the 0.98 level.

If we can break above that area, I feel that the market heads to the 1.00 level. This is an area that is of course going to be important because of the large, round, psychological aspect of it. On the other hand though, we have broken above there recently, so I don’t really think that there is going to be too much pushback if we go that high.

Very important level

I believe that the 0.95 level is going to be very important for the future of this currency pair. I believe also that the US dollar is going to strengthen overall, and as a result I think that this market will continue to go higher. Ultimately, I believe that the market falling would of course be a bit of surprise, but it would be an excellent sell signal so I would have to take it, no matter what the US Dollar Index is doing.

Pay attention to the other Swiss franc related pairs as they do tend to move in generally the same direction. With that, I believe that the market will be one that not only can you trade, but you can also use it as a tertiary indicator in order to trade the Swiss franc against almost all other currencies.