USD/JPY Signal Update

Yesterday’s signals may have provided an entry, as although there was an hourly close below 119.44 the close before the bullish reversal was only 1 pip below 119.15. Any long trade taken there would now be protected and should be left to run.

Today’s USD/JPY Signal

Risk 0.75%

Trades may only be taken between 8am and 5pm New York time only, or after 8am Tokyo time later.

Short Trade 1

Go short following a bearish price action reversal on the H1 time frame immediately upon the first test of 121.14.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride. Take further profit at 120.60.

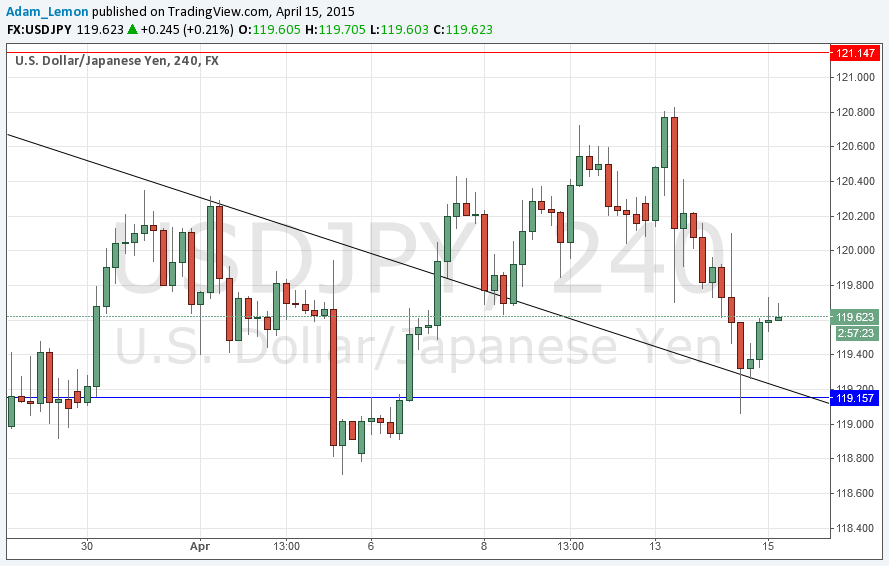

USD/JPY Analysis

After the support was broken yesterday at 119.44 it looked as though the support at 119.15 and the confluent trend line were also both going to be broken. However it was noticeable that this pair was not moving against the USD to the same extent that certain other currency pairs were: a bullish sign. The trend line eventually held on the higher time frames in any case, and the price has mildly rallied with a bullish bounce off 119.15. It is too soon to take another long if we return there and so far it has to be said that the rally does not look especially convincing. Furthermore, resistance above is unclear but there are lots of small bumps on that road so any ride up would quite probably be very choppy. The only clarity I see is resistance above 121.00.

There are no high-impact events scheduled later today concerning either the JPY or the USD.