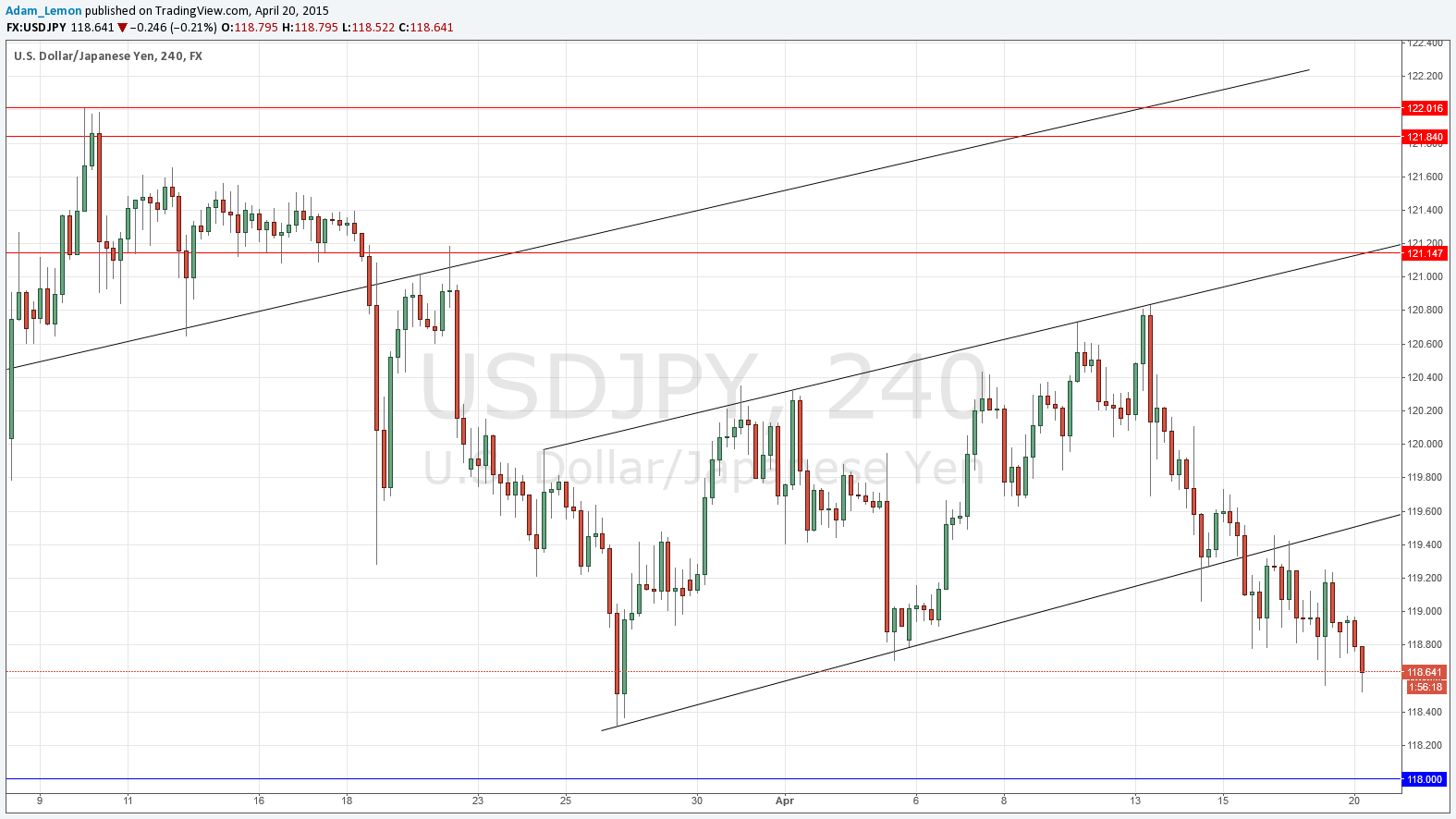

USD/JPY Signal Update

Last Thursday’s signals were not triggered as the price never reached either 121.14 or 118.00.

Today’s USD/JPY Signal

Risk 0.75%

Trades may only be taken between 8am and 5pm New York time only, or after 8am Tokyo time later.

Short Trade 1

Go short following a bearish price action reversal on the H1 time frame immediately upon the next retest of the broken bullish trend line currently sitting at around 119.60.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride. Take further profit at 118.10.

Long Trade 1

Go long following a bullish price action reversal on the H1 time frame immediately upon the first test of 118.00.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride. Take further profit at 118.50.

USD/JPY Analysis

We have had a series of bearish breaks of supportive trend lines for about a month now. Although the price of this remains a little higher than it was a few months ago, it seems to be showing that it wants to move down. The best opportunity to get short after a pullback should be at the most recently broken trend line which is currently sitting above at around 118.60.

Below, we can expect support at the next whole number of 118.00, which could provide an opportunity for a conservative long trade.

There are no high-impact events scheduled today concerning either the USD or the JPY.