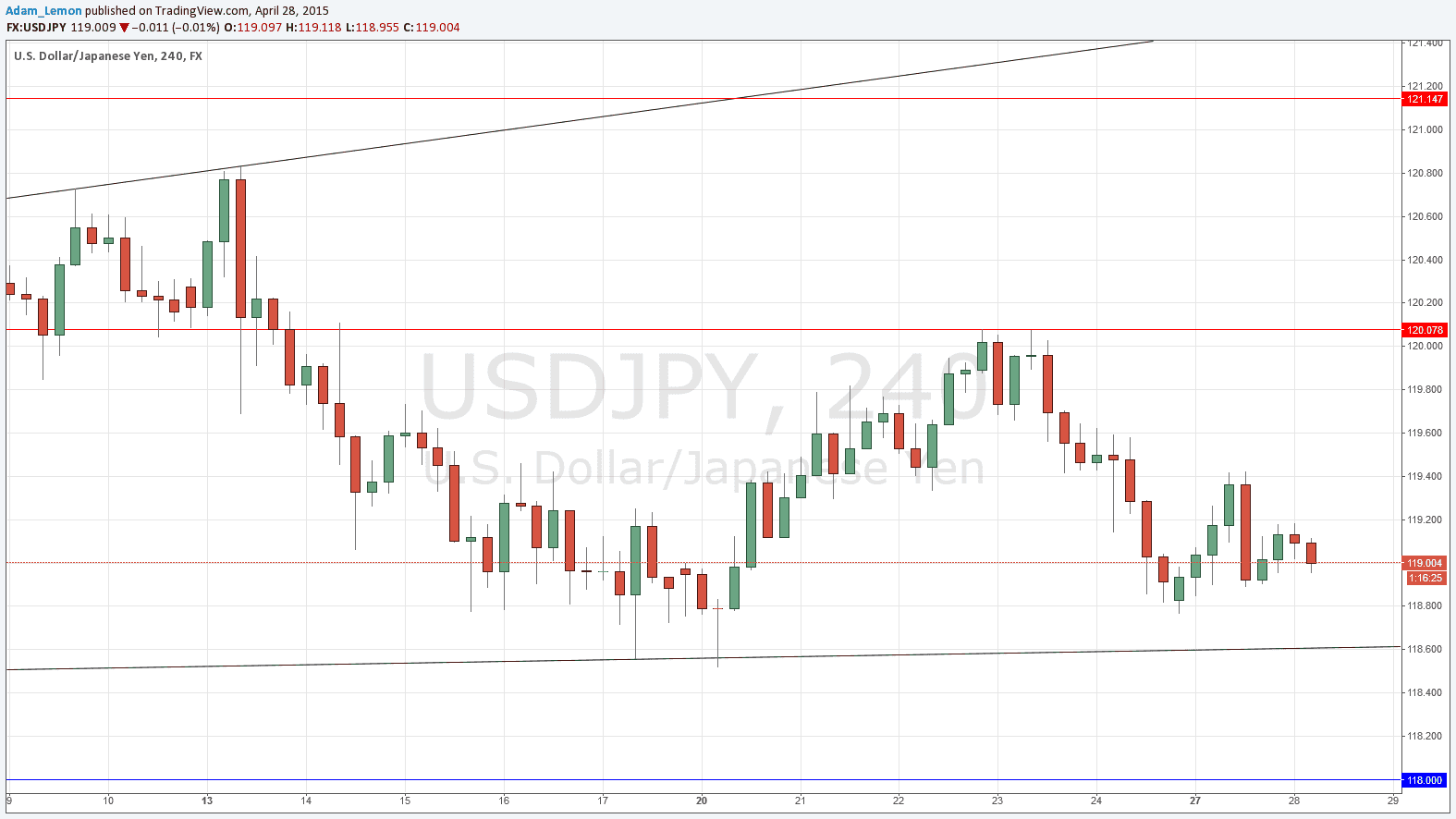

USD/JPY Signal Update

Yesterday’s signals were not triggered and expired as the price never reached either the bullish trend line or 120.07.

Today’s USD/JPY Signal

Risk 0.75%

Trades may only be taken between 8am and 5pm New York time only.

Short Trade 1

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 120.07

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 1

Go long following a bullish price action reversal on the H1 time frame immediately upon the next test of the bullish trend line currently sitting at around 118.61.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 2

Go long following a bullish price action reversal on the H1 time frame immediately upon the first test of 118.00.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/JPY Analysis

The pair remains waterlogged and there is has been no technical change in the situation over the past day. Tomorrow is a holiday in Japan so this pair is likely to remain quiet until we approach the FOMC announcement tomorrow night. However we might get a bounce up off the bullish trend line today that could be a good launching pad for a long trade if it is later supported by a USD-positive FOMC announcement tomorrow.

There are no more high-impact events scheduled today concerning the JPY as it is a public holiday in Japan. Regarding the USD, there will be a release of CB Consumer Confidence data at 3pm London time.