USD/JPY Signal Update

Yesterday’s signals were not triggered as although the price did reach 119.89, there was no bearish reversal there.

Today’s USD/JPY Signal

Risk 0.75%

Trades may only be taken between 8am and 5pm New York time only, or after 8am Tokyo time later.

Any trades taken before the FOMC news release should be protected by 6:30pm London time. New entries should not be made after the FOMC news release before 7:30pm London time.

Long Trade 1

Long entry following a bullish price action reversal on the H1 time frame immediately upon the first test of 119.44.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride. Take further profit at 120.00.

Long Trade 2

Long entry following a bullish price action reversal on the H1 time frame immediately upon the first test of 119.15.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride. Take further profit at 120.00.

Short Trade 1

Go short following a bearish price action reversal on the H1 time frame immediately upon the first test of 120.60.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride. Take further profit at 119.80.

Short Trade 2

Go short following a bearish price action reversal on the H1 time frame immediately upon the first test of 121.14.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride. Take further profit at 120.60.

USD/JPY Analysis

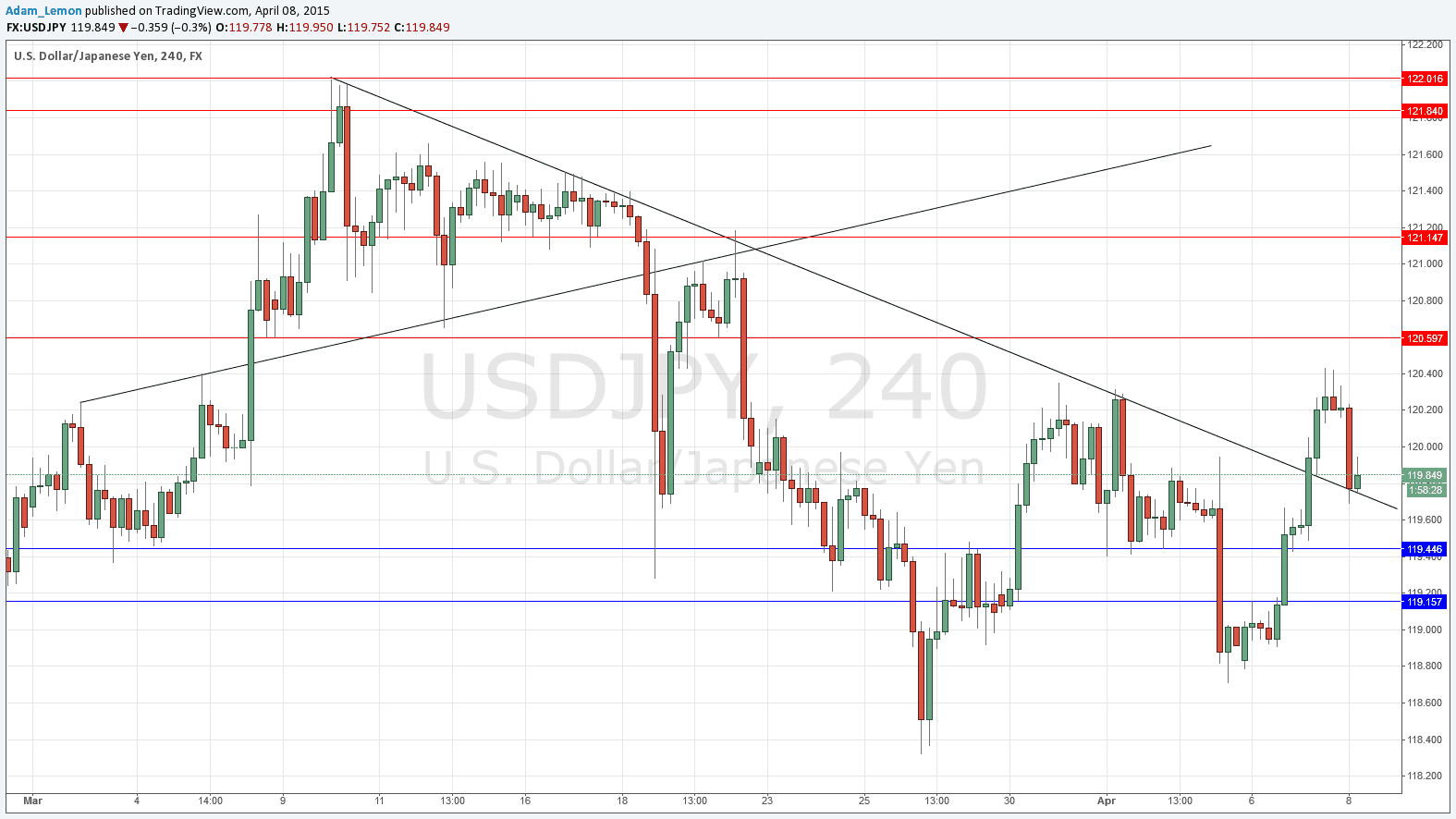

Yesterday saw an upwards move in this pair and a seeming breakout above a month-long bearish trend line that had been containing the highs.

However like most trend lines, this trend line has some ambiguity. Now the price has fallen back below the old trend line, it is re-drawn in the chart below to show where it is most likely to be powerful. Note that the price has not fallen below this new trend line yet, so it seems to be providing support. If the price does hold above the trend line until the FOMC report, this is a sign that the market is expecting something bullish. However there is too much ambiguity and time involved to use this trend line for signals: the horizontal levels should prove to be more reliable.

There are no high-impact events scheduled later today concerning the JPY. Regarding the USD, there will be a release of the FOMC Meeting Minutes at 7pm London time.