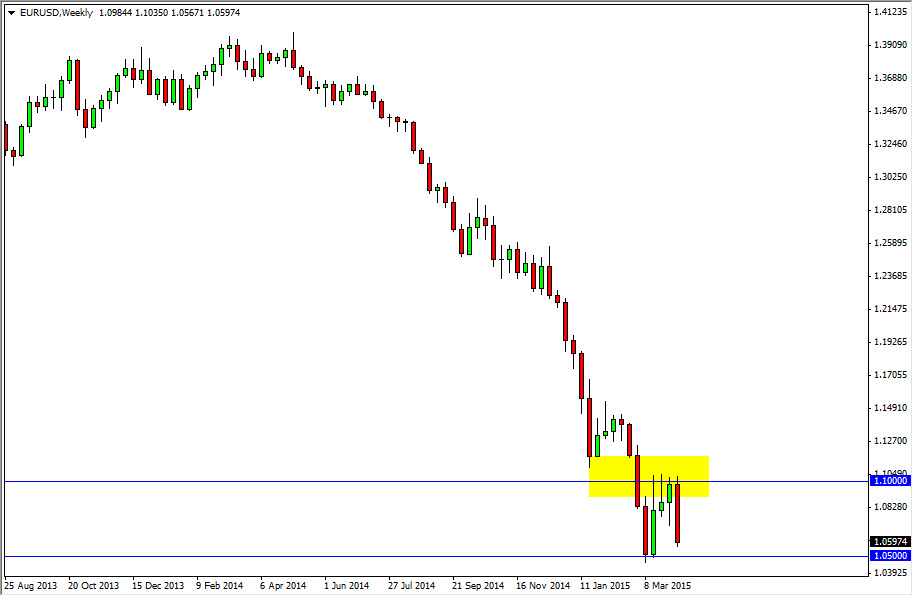

EUR/USD

The EUR/USD pair fell during the course of the week, showing the 1.10 level to be resistive yet again. Because of this, we should see this market head down to the 1.05 handle, and could perhaps finally see the breakdown below there. Once we get below the 1.05 level, it seems like only a matter of time before this market heads down to the parity handle. Ultimately, I look at any rally at this point in time as a selling opportunity and have absolutely no interest in buying the Euro. I believe that the downtrend does in fact continue, I just don’t know if we break down this week or not.

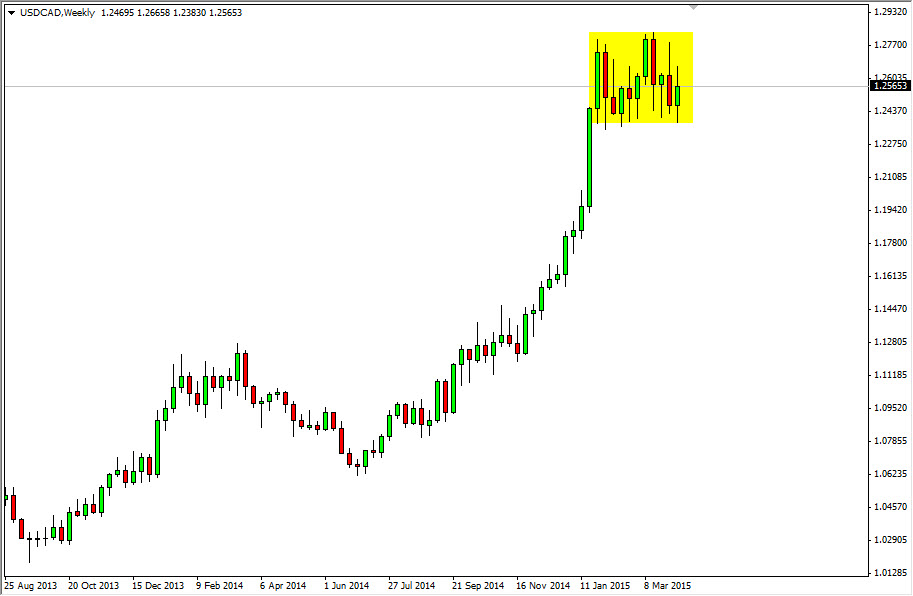

USD/CAD

The USD/CAD pair bounced off of the bottom of consolidation this week, forming a somewhat positive candle, but quite frankly there are far too many back and forth days to get overly excited. Ultimately, I believe that this pair does go higher but the volatility continues in my opinion. I think that short-term pullbacks will probably be buying opportunities, and that will be the way a trade this market, off of the short-term charts. I believe that we continue to stick between the 1.24 level on the bottom, and the 1.28 level on the top. I do not anticipate breaking out this week.

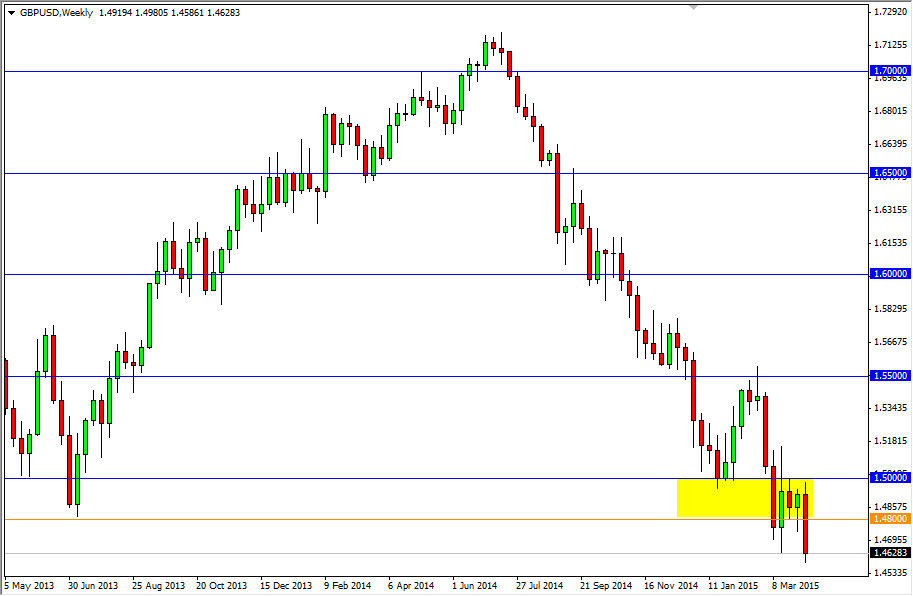

GBP/USD

The GBP/USD pair fell hard during the course of the week, slicing back below the 1.48 level. On top of that, we closed below that level decisively, so this means that we should continue to go much lower. I believe that the market should then head to the 1.45 handle, which of course is the next major round number. Any rally between now and then should be a selling opportunity as far as I can see off of the shorter-term charts.

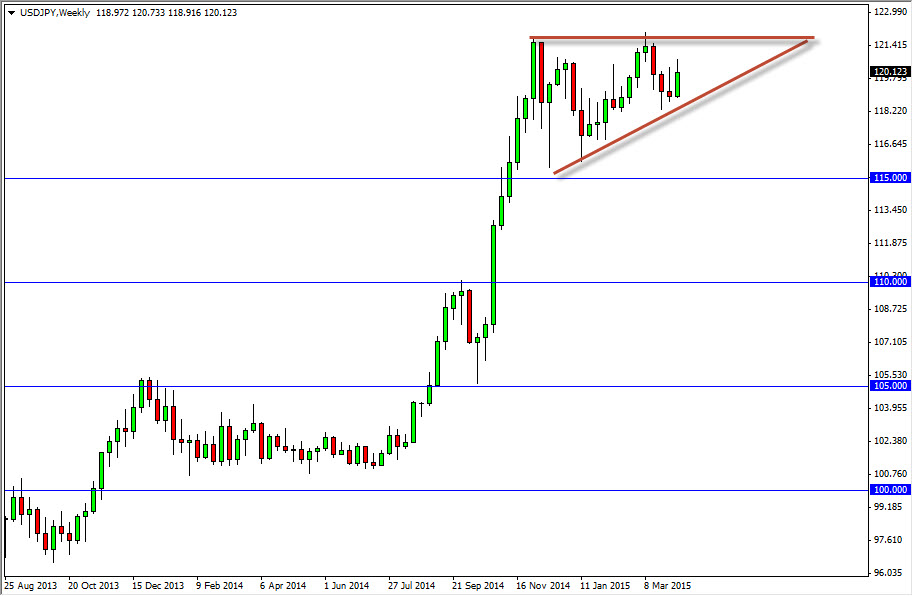

USD/JPY

The USD/JPY pair broke higher during the course of the week, breaking above the top of the shooting star from the previous week at one point. However, if you look at the chart attached, you can see that there is a significant ascending triangle forming, and of course we have been in a nice uptrend. Because of this, I do believe that we are building enough momentum to finally break out to the upside soon. I look at pullbacks as buying opportunities, and I believe that it’s only a matter time before we break above the 122 level, and then head to the 125 level.