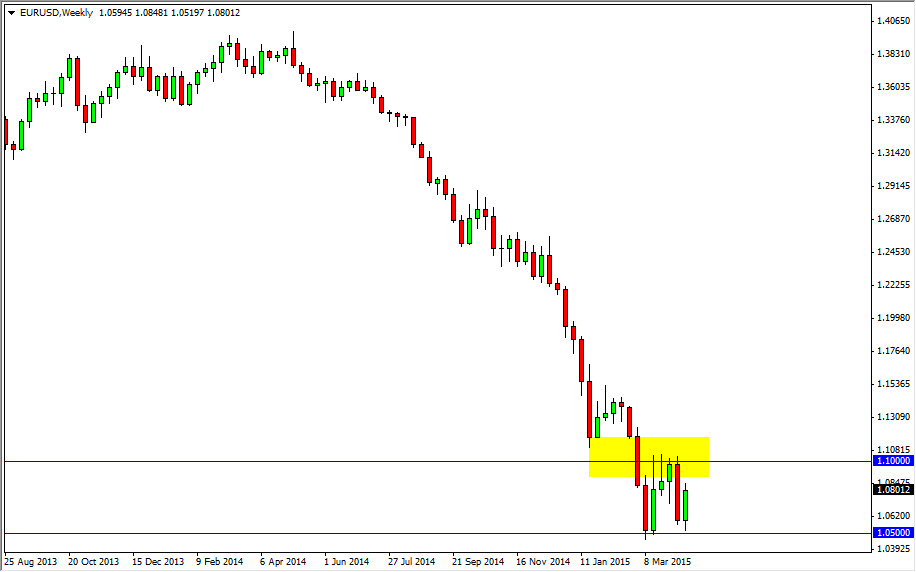

EUR/USD

The EUR/USD pair initially fell during the course of the week but found the 1.05 level to be a bit too supportive, and as a result the market ended up turning back around. The bounce went to the 1.08 level, where we saw significant amount of resistance. However, it is not until we get to the 1.10 level that we are out of the consolidation area, so it’s more than likely going to be a selling opportunity before it’s all said and done. I am selling resistive candles.

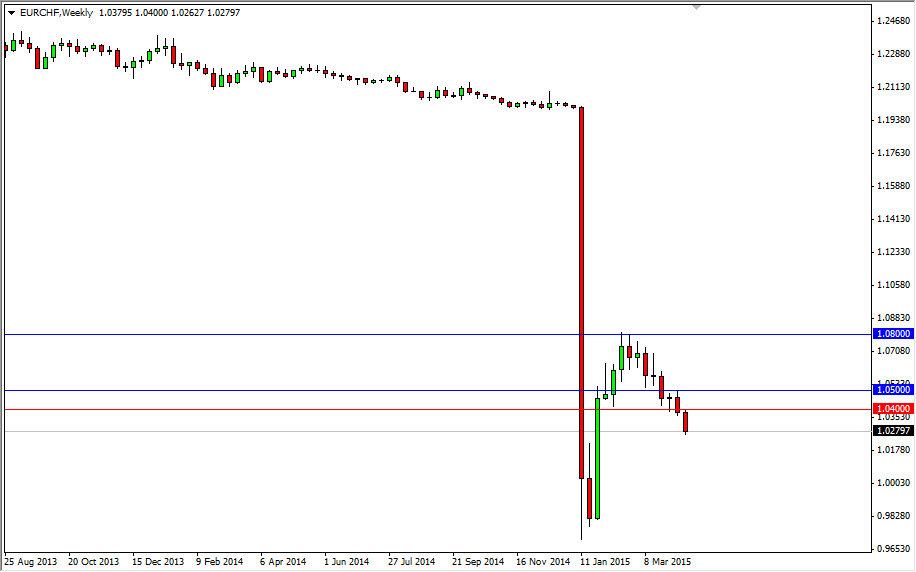

EUR/CHF

The EUR/CHF pair fell hard during the course of the week, as the market has broken through support at the 1.04 level. With that, it appears that the market should then head to the parity level, which is my longer-term target. Any rally at this point in time should be a selling opportunity in my opinion, and as a result I have no interest whatsoever in going long. I believe that this pair continues to fall given enough time, and with that we are more than likely going to see selling again and again.

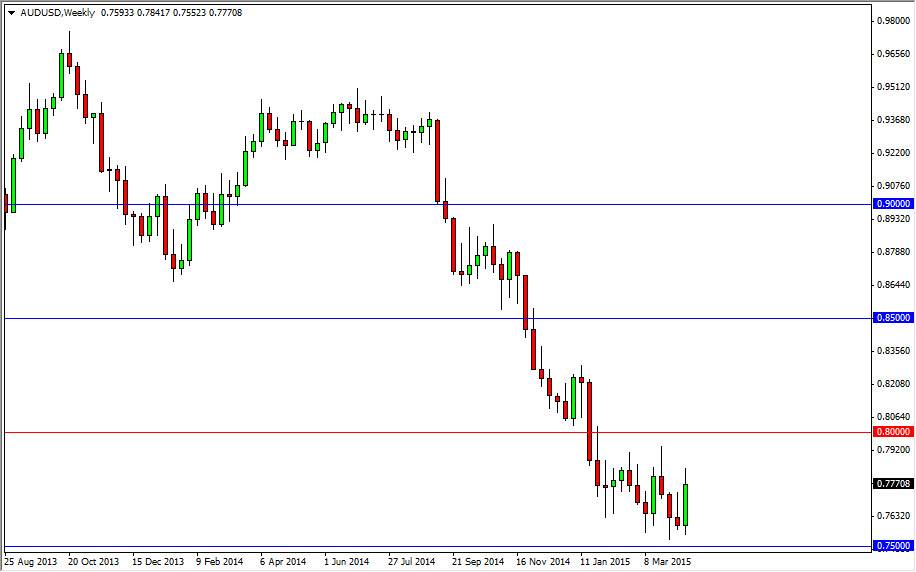

AUD/USD

The AUD/USD pair broke higher during the course of the week, showing the 0.75 level be supportive. Ultimately, the market should continue to find resistance above though, especially at the 0.80 level, an area that I think is essentially the “ceiling” in this market. With that, I am very bearish of the Australian dollar in general, but will wait for resistive candles. That being said, the Friday candle was just that. Because of this, I anticipate lower pricing by the end of the week.

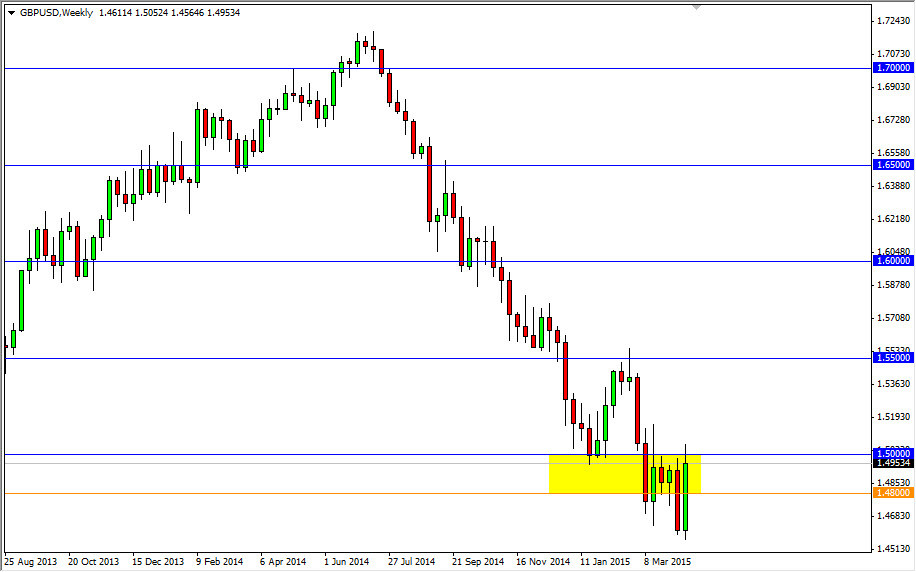

GBP/USD

The GBP/USD pair broke much higher during the course of the week, testing the 1.50 level. With that being the case, the market looks as if it is ready to turn back around and the shooting star that formed on Friday certainly says so as well. With this, I anticipate selling opportunities all week, as we should head back down towards the 1.46 level. I have no interest in buying until yet well above the 1.52 handle.