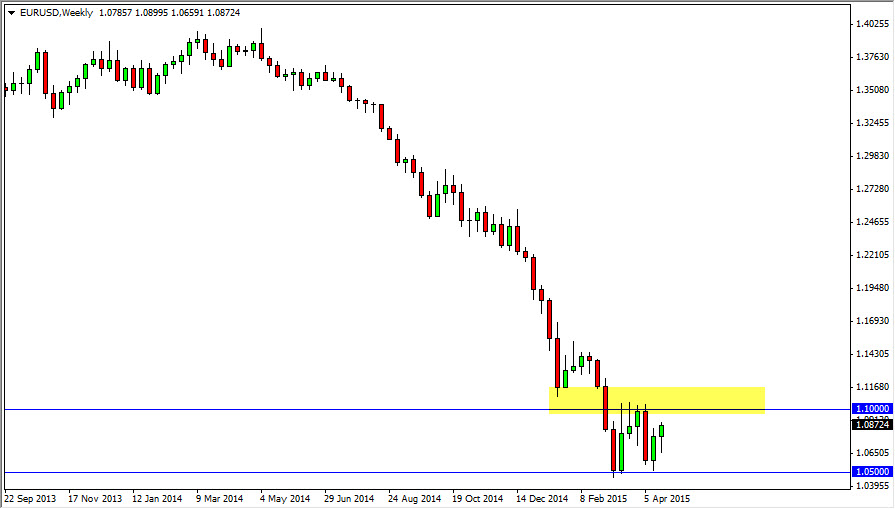

EUR/USD

The EUR/USD pair initially fell during the course of the week, but found enough bullish pressure underneath to turn things back around and form a nice-looking hammer. The hammer suggests that the buyers are going to take control, but I see a significant amount of resistance of the 1.10 level, and with that I believe that short-term buying may be the way to go early in the week, but it’s only a matter time before the sellers step back in. Expect a lot of volatility regardless of what happens.

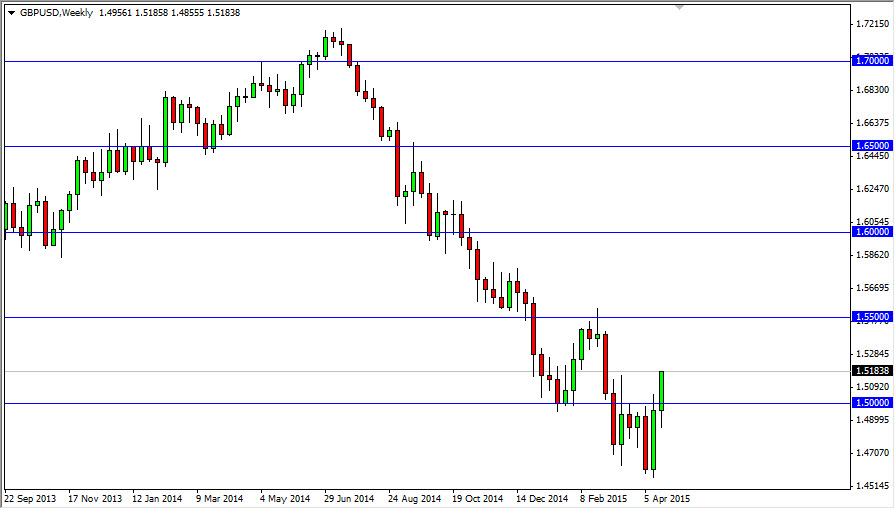

GBP/USD

The US dollar has been fairly strong lately, but got a bit of a surprise this past week as the British pound took off to the upside. On top of that, I think if we get above the 1.52 level, the market should then head to the 1.55 level given enough time. We closed at the top of the range of the week, and as a result it’s very likely that we continue to go higher over the course of this next week. Expect a little bit of a push back from time to time, but I think the buyers are starting to take control now.

EUR/CHF

The EUR/CHF pair had a slightly positive week, testing the 1.0450 level for resistance and finding it. Ultimately, the market looks as if it is ready to continue going lower as long as we stay below the 1.05 handle. If we do get above there, then this market will more than likely head to the 1.08 level next. Ultimately though, I am a bit more comfortable selling at this point in time, as we should then head to the parity level given enough time. The candle itself for the week suggests that we should have a bit of choppiness.

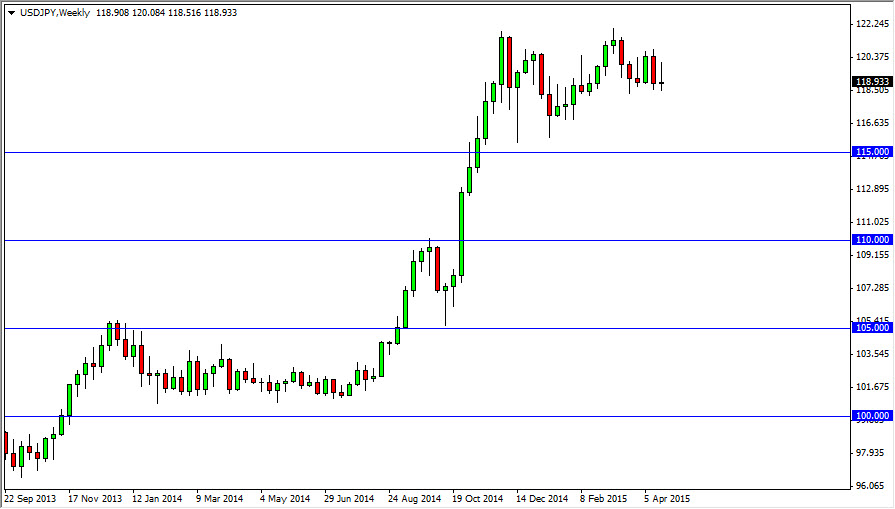

USD/JPY

The USD/JPY pair initially tried to rally during the course of the week, but fell from the 120 level to turn things back around and form a shooting star. The shooting star of course is sitting on significant support from the last month or so, so really at this point in time I think that even if we fell from here you would have to be very careful. Any type of supportive candle would be a buying opportunity in my opinion, and that’s exactly what I will be looking for.