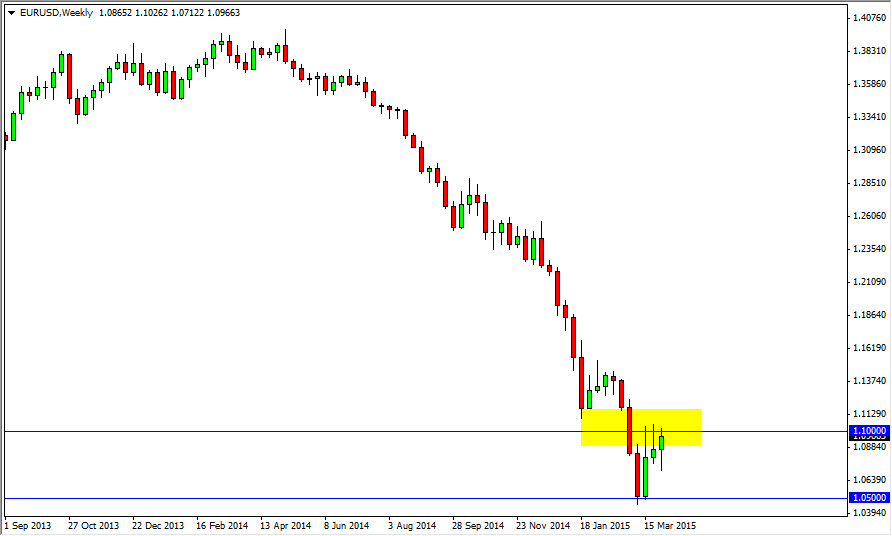

EUR/USD

The EUR/USD pair initially fell during the course of the week, but as you can see the buyers stepped back in to form a hammer as we press up against the 1.10 level. However, I really struggle with the idea of going long of the Euro, simply because it is far too many issues involved in owning that currency. It’s not until we get above the 1.15 handle that I’m willing to start buying, so I think some time during this week on shorter-term charts you may find selling opportunities as we find value in the US dollar.

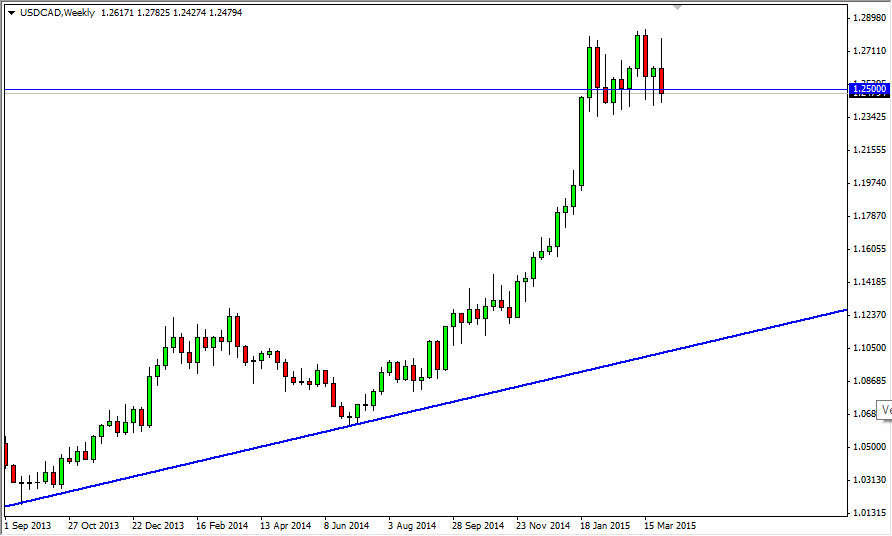

USD/CAD

The USD/CAD pair initially broke higher during the course of the week, but found enough resistance of the 1.28 level to fall back down and form a shooting star. The shooting star of course sits just above the 1.24 level, which of course has been massively supportive. At this point time though, it looks like we could pull back a little bit and if we do we feel that we should find value at lower levels on supportive candles. I’m buying pullbacks, as well as supportive candles in this general vicinity.

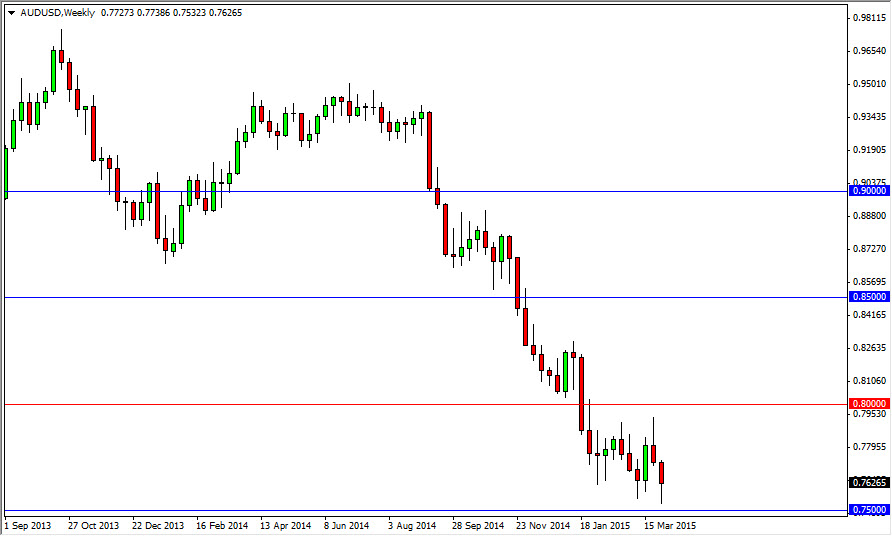

AUD/USD

The AUD/USD pair fell during the course of the week, testing the 0.75 level. With that being said, we bounced enough to form a hammer and I believe this simply means that we’re going to continue to consolidate between the aforementioned 0.75 handle, and the 0.80 level above. Expect a lot of the same going forward.

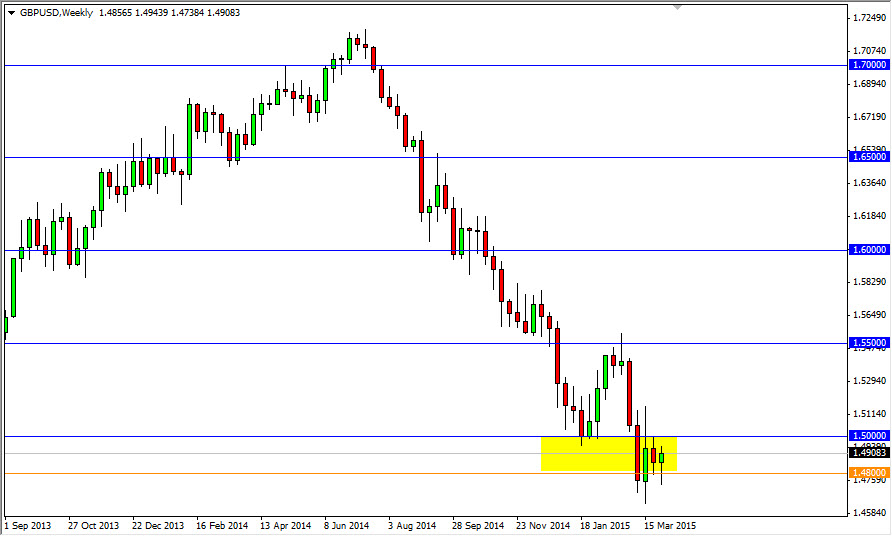

GBP/USD

The GBP/USD pair broke down below the 1.48 level, but turned back around to form some type of hammer. The hammer of course suggests that the markets going to go higher, but is not until we get above the 1.52 level that I’m comfortable enough to start buying. Once that happens, I think we had to the 1.55 level which I believe is the determining factor as to whether or not we are still in a downtrend. On the other hand, if we break down below the bottom of the hammer from this past week, I feel that the market sells off and heads to the 1.45 level.