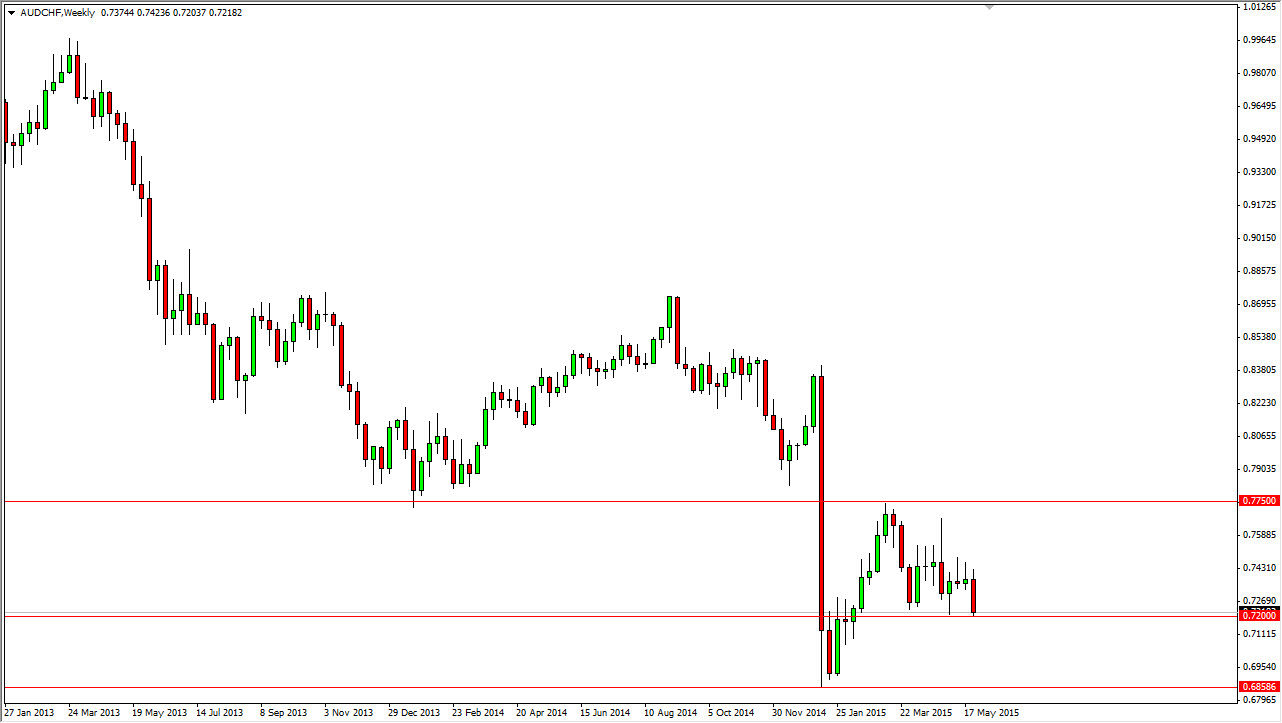

The AUD/CHF pair fell during the course of the last couple of weeks, and it looks like we are trying to break down below the 0.72 level. That is an area of that if it gets broken, should send this market looking towards the 0.70 handle next, and then the 0.6850 region.

What I like about this particular pair is that the Australian dollar is considered to be “risky”, while the Swiss franc is considered to be “safe.” In other words, this is a market that is highly influenced by risk appetite, and gives you an idea of just how the markets feel. This gives you an idea how to trade other assets as well, such as gold, stock markets, and of course other Forex pairs. With that being the case I feel that it looks as if stock markets may pull back a little bit during the month, but ultimately this market could give you a “heads up” as to what to do.

Risk on, risk off

Because of the “risk on, risk off” nature of this market, I will be paying attention to this pair in order to do get an idea as to how to trade those markets. With that being the case, I believe that this market is one of many tools as you can use in order to trade both stocks and commodities. On top of that, it does tend to move rather quickly, so if we can get below this area, we feel that the move could be rather sweat. On the other hand, if we get some type of support in this general vicinity of 0.72, we could very easily bounce around between 0.72 and 0.76 over the course of the next couple of weeks. With that, I am very interested in this pair but recognize that the Australian dollar itself has been struggling in general, and it does look like the Swiss franc is starting to attract more attention in general. With that, I have more of a negative bias than anything else, but need confirmation first.