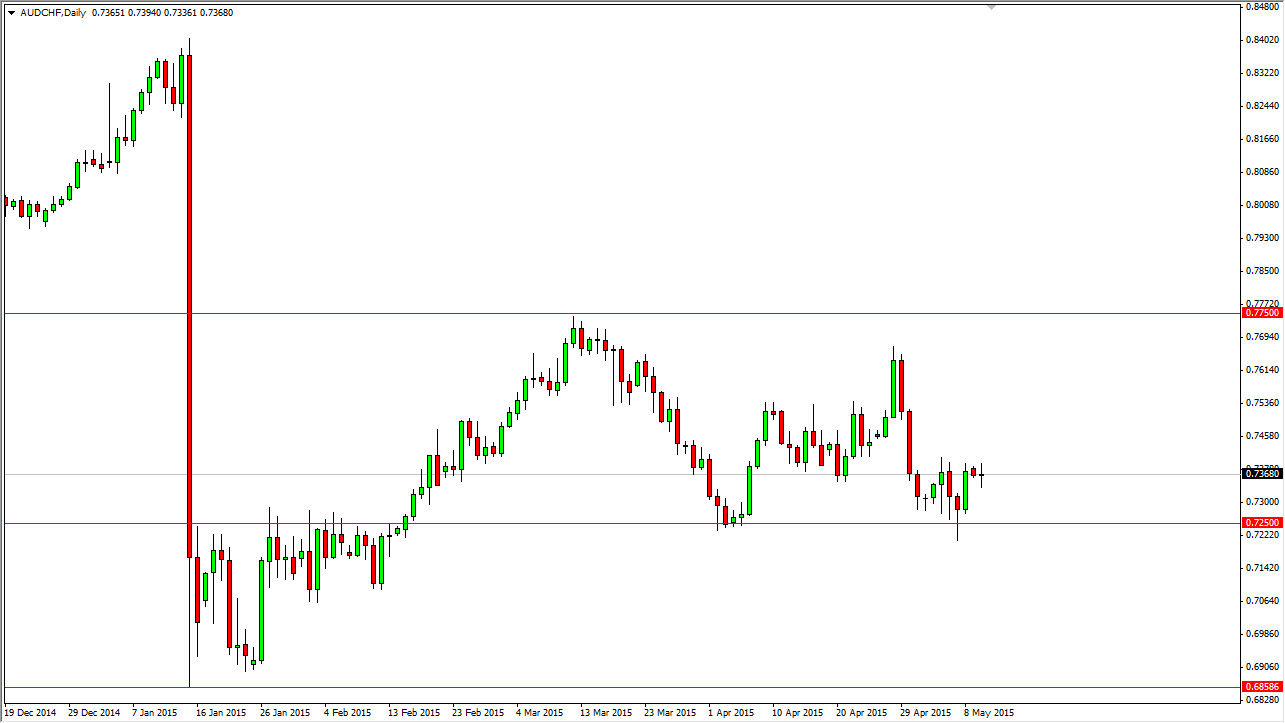

The AUD/CHF pair did nothing during the session on Monday, as we essentially continue to hug the 0.7350 region. This is an interesting pair, and under normal circumstances is one of my favorite ones to follow. This is because the Australian dollar is considered to be a “risky” currency, while the Swiss franc of course is considered to be one of the safest currencies to own in the world. Because of this, it is an excellent barometer on risk appetite around the world, as there will be more demand for the Australian dollar when people are feeling fairly confident about economic conditions. On the other hand, if they are buying the Swiss franc and driving this pair lower, it’s generally a sign that people are becoming concerned about economic growth or other factors such as conflict in the Middle East, commodity prices, or just about anything else you can think of that is bad for asset prices.

Massive support below

Although we didn't necessarily take off, I’m not a huge fan of the Australian dollar, and recognize that the 0.7250 level just below is massively supportive. It is because of this I’m willing to take short-term long positions on pullbacks, but I’m not looking for anything that is going to change my life as far as results are concerned. Quite frankly, if I was to grade this set up on a five-star system, I would probably rank it somewhere about 3.5 or possibly even four stars. Yes, I think that short-term traders will continue to take advantage of the support below, because quite frankly it was massively resistive in the month of January and most of February. Because of that, I think there will be a certain amount of bouncing off of that area going forward, so I certainly wouldn’t sell here. We’re talking about possible short-term buying opportunities they gain somewhere near 100 pips, but probably not much more than that. If we break above the highs for the session on Monday, I believe that we will then grind our way to the 0.7550 region, and then possibly even as high as 0.7750 which I see as the major “ceiling” in this pair.