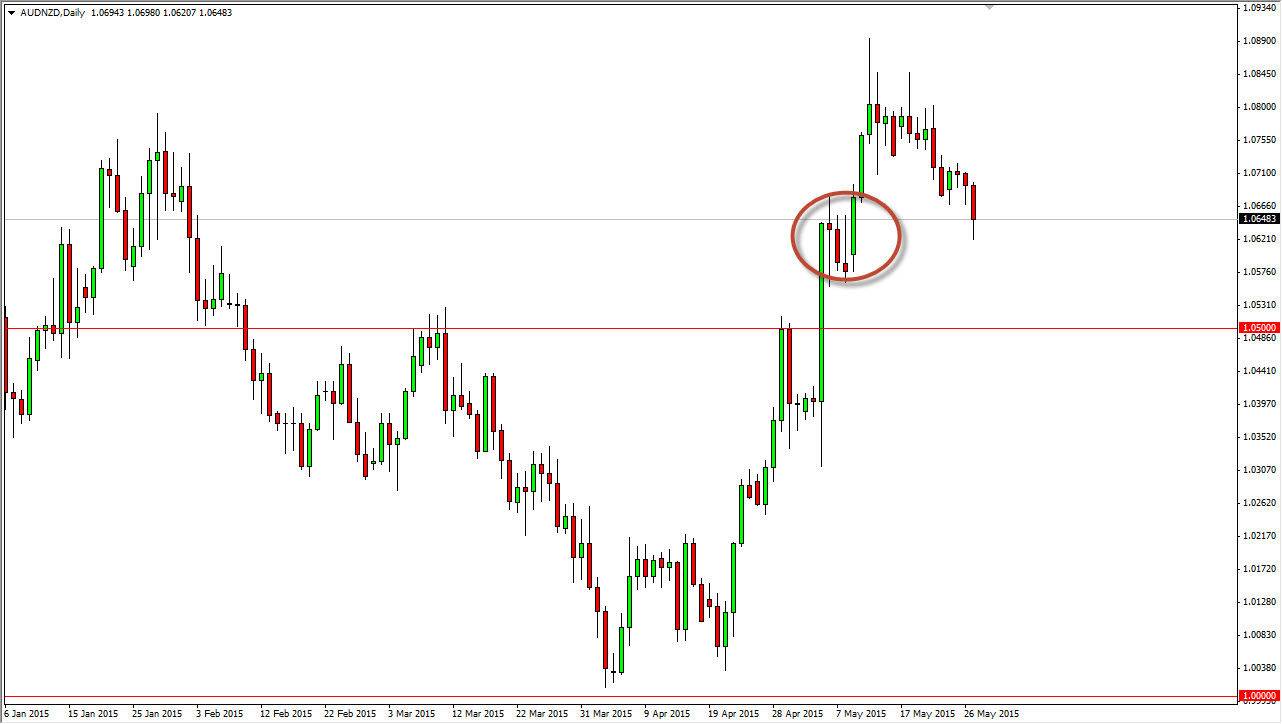

The AUD/NZD pair fell during the session on Wednesday, going as low as 1.06 at one point. However, the market did in fact find support below and bounced slightly. The 1.06 level in and of itself is in a major handle, but there is a cluster that I have highlighted on the accompanying chart that suggests there should be quite a bit of buying pressure in this area. With this being the case, and the 1.05 level below almost certainly been supportive, I believe that we will get a buying opportunity soon. This isn’t a real stretch really, because the quickest way to look at which one of the Antipodeans should do better is to simply look at both the AUD/USD pair, and the NZD/USD pair. The AUD/USD pair certainly looks a bit healthier, and that tells us that the Australian dollar overall is stronger. In a sense, you can triangulate both of those pairs in this one to decide which one to trade because they all tend to move in tandem.

Looking to short-term charts

I’m going to be looking for supportive candles on short-term charts in order to start buying, because I believe that the impulsive move that we have seen over the last couple of months is convincing enough to believe that the Australian dollar is in fact going to continue to go higher against the New Zealand dollar given enough time. On top of that, it looks like gold is trying to find some support near the $1180 level, and if that holds out to be true, that should also help the Australian dollar more so than the New Zealand dollar which is more or less a general commodity currency as opposed to the Australian dollar being so sensitive to gold and other minerals.

On a supportive short-term candle, I believe that this market heads back to the 1.09 level, with the 1.08 level being a bit of a fight as well. Ultimately though I think we go much higher, as this pair is at historic lows. For the longer-term trader, you can probably buy-and-hold.