AUD/USD Signal Update

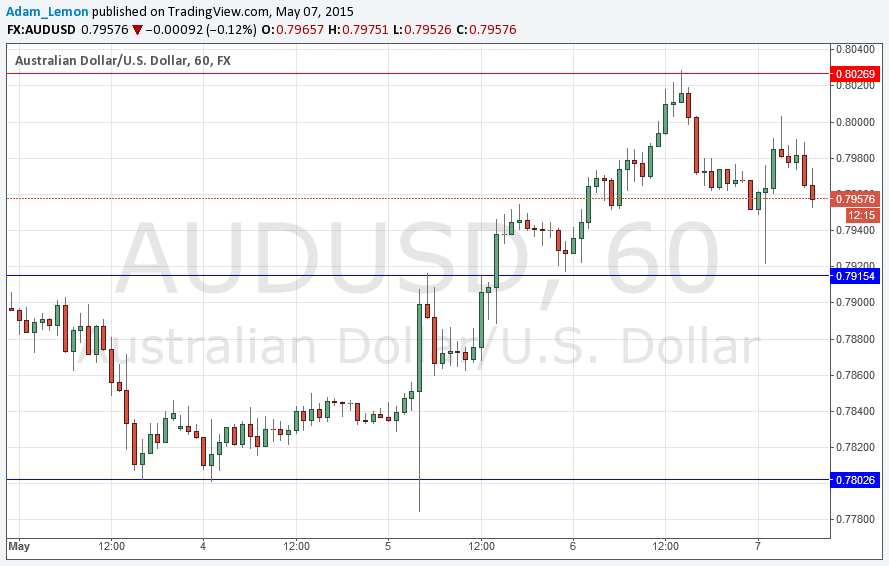

Yesterday’s signals gave a perfect short entry during the early part of the New York session as the anticipated resistance at 0.8027 held almost to the pip. It might be a good idea to take some more profit as there is new support below at 0.7914.

Today’s AUD/USD Signals

Risk 0.75%

Trades may only be taken between 8am and 5pm New York time only, or after 8am Tokyo time later.

Long Trade 1

Go long following some bullish price action on the H1 time frame immediately upon the next touch of 0.7915.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 2

Go long following some bullish price action on the H1 time frame immediately upon the next touch of 0.7803.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

Go short following bearish price action on the H1 time frame immediately upon the next entry into the zone between 0.8027 and 0.8073.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

AUD/USD Analysis

This pair was already falling during the New York session and was pushed down further by disappointing economic data from Australia. The pair looks somewhat bearish now but much will depend upon the forthcoming news for both sides of this pair.

There is new support at 0.7915 that might be the first test of any attempt to drive down.

There are high-impact events scheduled today concerning both the AUD and the USD. There will be a release of U.S. Unemployment Claims data at 1:30pm London time. After Australia opens, the RBA will release their Monetary Policy Statement at 2:30am.