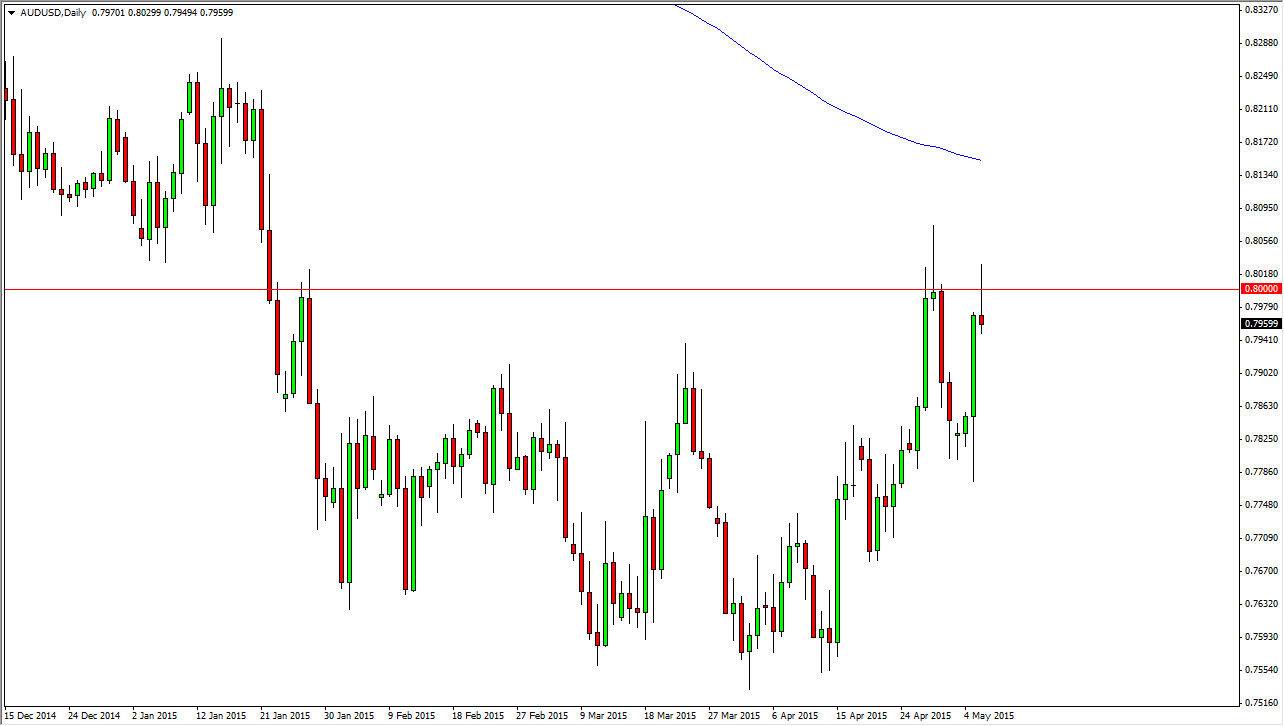

The AUD/USD pair initially rose during the session on Wednesday, and even broke above the well-known 0.80 resistance barrier. However, just as it did last time we broke above this level, the market turned back around and formed a shooting star. With this, it appears that the 0.80 level continues to be far too resistive for the market to maintain gains above, and we did it at a lower level this time. Because of this, I feel that this market is in fact very bearish. I recognize that we have been rallying lately, but the fact that we have potentially made a “lower high” at the same region tells me that the sellers might be getting a little bit more aggressive.

I recognize that this Friday is Nonfarm Payroll day. With that, I think that the market might be fairly quiet today, but certainly it appears that we could see a bit of a “risk off” type of situation, especially if that announcement is poor. If that’s the case, the Australian dollar should be sold by a preponderance of market sentiment.

Selling a break of the candle

I am simply going to sell a break of the bottom of the candle for the session on Wednesday as it is a classic sell signal as far as technical analysis is concerned. If we break down below the bottom of the candle, I believe that this market will more than likely head to the 0.78 handle. Below there, things do get a little bit rocky but I think if we go lower than that, we will more than likely see this market try to reach all the way down to the 0.7550 level.

Gold markets haven’t exactly looked bullish, so at this point in time I would not anticipate a lot of help from that particular market. The US dollar has been a bit soft, but it seems like there is a little bit of a divergence going on. European currency seem to be doing a little better, while commodity-based currencies such as the Australian dollar, New Zealand dollar, and Canadian dollar all appear to be vulnerable based upon the last 24 hours.