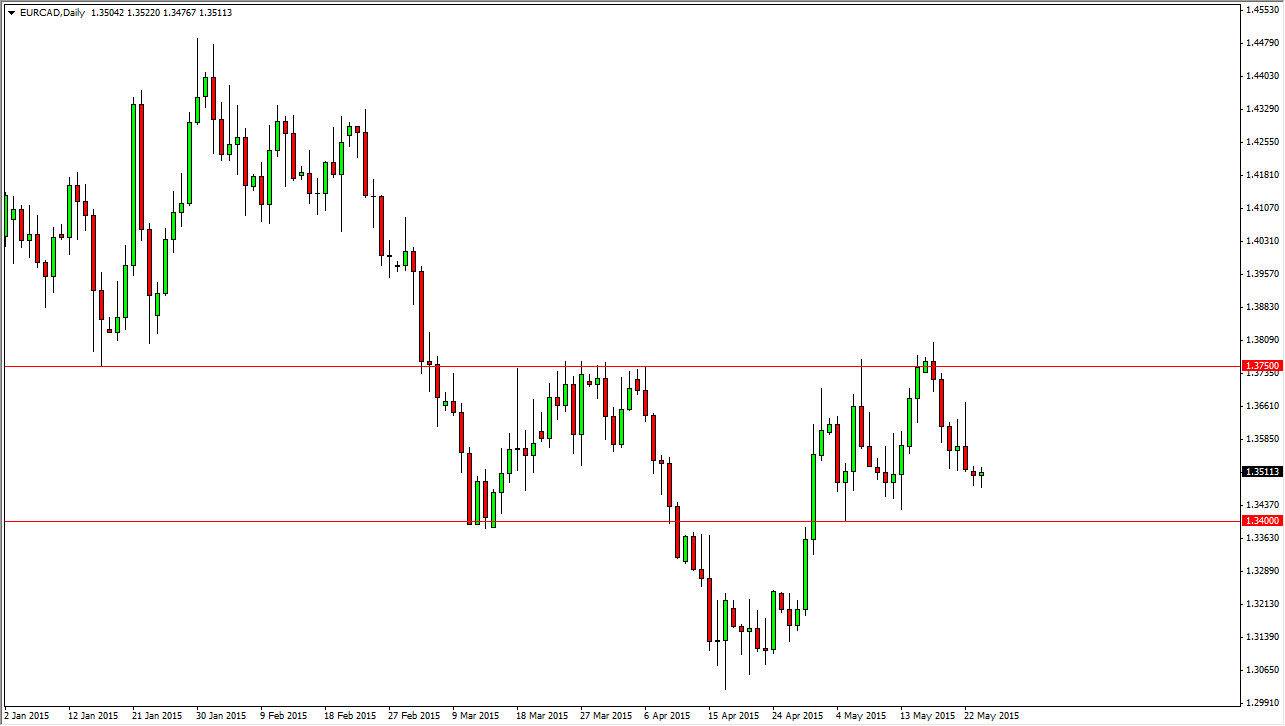

The EUR/CAD pair fell initially during the course of the day on Monday, but turned back around to form a slight hammer. Nonetheless, when I look at this pair I recognize that we could possibly be trying to form a little bit of an inverse head and shoulders. Of course we would have to break above the 1.3750 level in order to confirm this. If we got above there, this would be a very bullish sign as we should then head towards the 1.44 handle.

Ultimately though, I believe that the market is currently just trying to consolidate between the 1.34 level, and the 1.3750 level. With this, and the fact that we are closer to the bottom of the range, I am more apt to start buying at this point in time. On top of that, you cannot forget the correlation between the Canadian dollar and the oil markets.

Oil markets

I believe that the oil markets continue to be very volatile, and that of course will have an influence on the Canadian dollar in general. That being the case, the market looks like it will continue to be very volatile regardless, because of the correlation. The markets breaking below the 1.34 level below though would be very bearish, and probably coincide with a breakdown in the EUR/USD pair.

On the other hand, if the EUR/USD pair breaks higher, we will more than likely head towards the 1.3750 level again and perhaps break that inverted head and shoulders as I had pointed out previously. With this though, I do believe that the next day or two we will be going higher, just simply because there is so much in the way of support below.

While the USD/CAD pair is thought of as being very sensitive to the oil markets, the EUR/CAD pair is very much the same in that sense. Of course, we have a lot of drama coming out of Athens, but ultimately I believe that the market will offer quite a bit of trading opportunities.