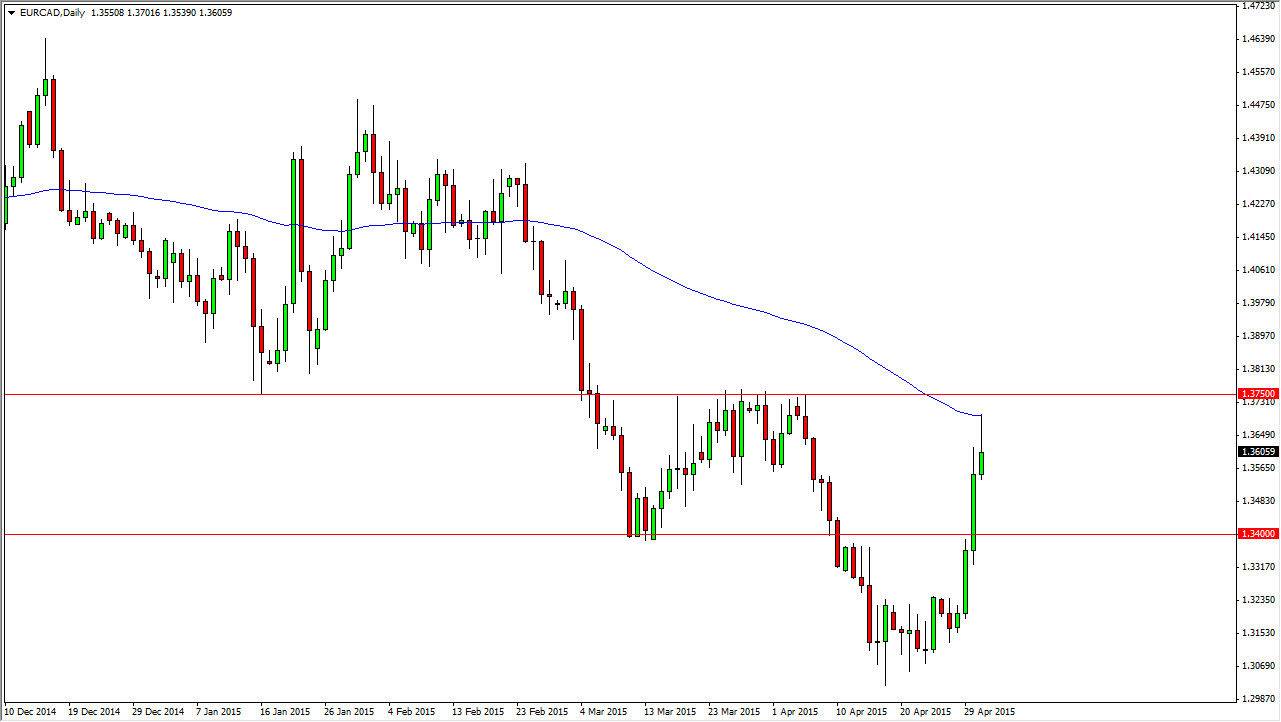

The EUR/CAD pair rose during the session on Friday as all EUR related pairs did. However, this market did the same thing most of the European currency related markets did, pulled back. By the time that the market closed, we ended up forming a shooting star. On this chart, I have plotted the 100 day exponential moving average. This is a favorite moving average by longer-term traders, and because of that I believe that a lot of them have been alerted to a potential selling opportunity. On top of that, it is at the 1.3750 level, an area that has been resistive in the past. Based upon the candle and the average, and of course the round number, I believe that the market is ready to start pulling back.

Overbought

The Euro is overbought in general. With this, I think that this market will more than likely pullback to the 1.34 level, an area that offered support previously. I believe that the Canadian dollar isn't necessarily the greatest currency to own out there, but at this point in time it is most certainly going to be a bit more of a safe bet than the Euro itself which of course has quite a bit of trouble around it.

Ultimately, the market should at least back down to the 1.34 level, and if we can break below there I believe that the market will then go to the 1.30 handle, which is where we found a significant amount of support last time. I don’t really have an argument to start buying this pair, unless of course we get above the 1.30 handle which at that point in time I think that we would head to the 1.40 level. Pay attention to the EUR/USD, if it breaks out to the upside we could possibly get this move, but at this point in time I wouldn’t necessarily count on it. Ultimately, I think selling is going to be the safer bet, at least down to the 1.34 or so.