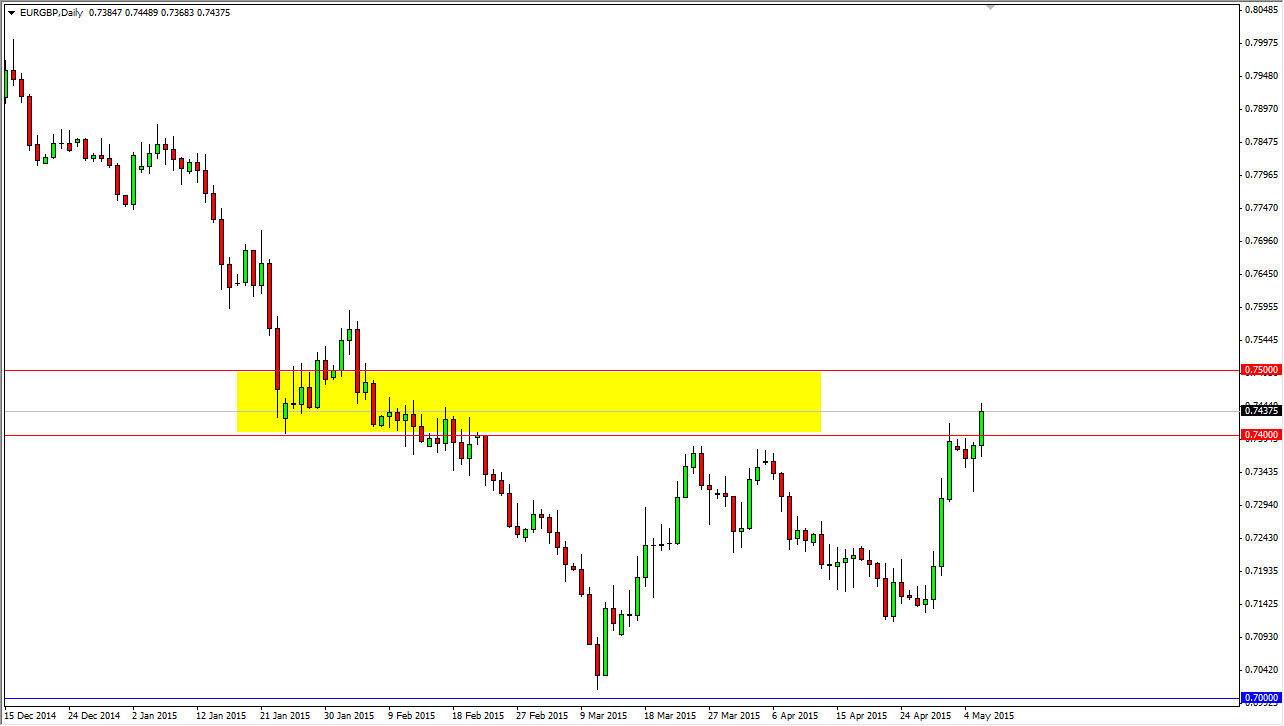

The EUR/GBP pair rose during the session on Wednesday, breaking above the 0.74 handle. This is an area that I think is very interesting to pay attention to because I think there is a significant amount of resistance all the way to the 0.75 handle. However, the fact that we formed a hammer during the session on Tuesday, and then broke higher on Wednesday is very bullish. I think it’s only a matter of time before this pair breaks out above the 0.75 handle as the Euro suddenly looks to be very resilient. I think it’s not necessarily a matter of European strength rather than it is a matter of the Euro has probably been oversold in general. Once we get above the 0.75 level, I think the market will really start to take off to the upside, probably heading to the 0.78 handle next.

Rocky road ahead

I believe that it is going to be a bit bumpy between here and 0.75, so while I’m not necessarily excited about buying this pair, I do see the potential for to go higher. Nonetheless, this is a market that should be watched, as the resilient nature of the Euro has definitely been shown here. I think that the hammer that formed on Tuesday will essentially end up forming a “floor” in this marketplace, and we may have seen the lows for the year already.

Because of this, I think that sooner or later you are going to see a break out to the upside of significance, and I think that you can continue to buy dips. I think that the Euro is going to do fairly well in the near term overall, but having said that I don’t have an interest in this market until we break above this resistance zone. Once we do, I think this pair will be very strong. Quite frankly, I have no scenario in which I'm willing to sell this market right now.