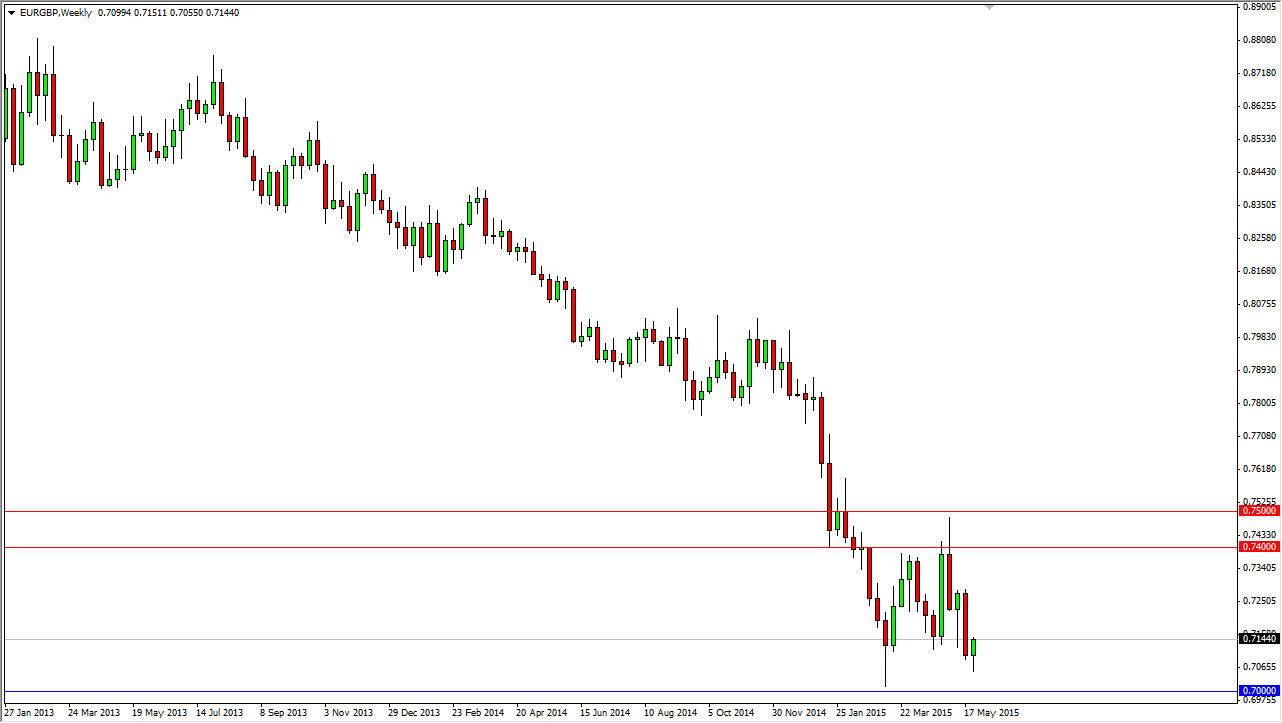

The EUR/GBP pair initially fell during the course of the last couple of weeks, but as you can see has found a bit of support at the 0.71 level. That being the case, the market looks as if it should continue to consolidate between the 0.70 level and the 0.74 level. I believe that it’s only a matter of time before we break out, but in the short-term we have to assume that the consolidation area holds. Quite frankly, above the 0.74 level, I see a significant amount of resistance at the 0.75 level as well. In other words, it’s going to take quite a bit of momentum to break out to the upside.

Ultimately, it is not until we get above the 0.75 level that we consider this market to have changed the trend overall. In the meantime, you have to assume that we are staying within this area, and therefore I feel that it’s only a short-term buying opportunity followed by a short-term selling opportunity.

Short-term trades should continue to work out

Looking at this chart, I believe that you will have to switch over to short-term trades, but quite frankly this should continue to benefit options traders as well, as you can simply sell premium in both calls and puts in order to take advantage of what is a very well defined range. I believe that the markets are offering an opportunity if you are nimble enough, and it is certainly one that can add to your account.

With this, I will continue to be involved in this market rapidly shifting back and forth, but that being the case it is a market that you will have to use hourly charts or even for our charts in order to be involved in. Keep in mind that both of these currencies are possibly of a crossroads, and as a result it’s going to be very volatile. Quite frankly would not surprise me at all if the month of July turns into being much like the month of June as well.