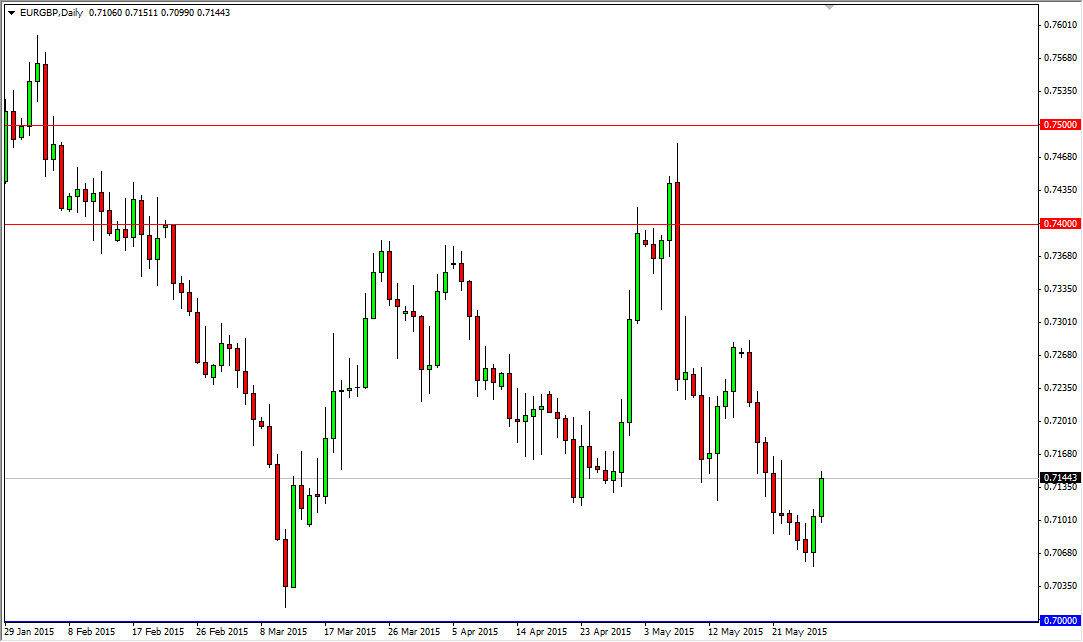

The EUR/GBP pair broke higher during the course of the session on Thursday, slamming into the 0.7150 level. This is an area that was supportive recently, so the fact that we bounced to this area suggests to me that we are going to have a little bit of a fight on our hands today. However, I recognize that if we can get well above this area, then we could very well go as high as 0.73 where we had seen a significant amount of resistance. Ultimately, if we can find some type of resistive candle in this area though, it could be a nice selling opportunity.

I think that the market is going to continue to respect the 0.70 level, and it is possible that we simply bounced in order to build up enough momentum to try to break down below that significant area. Because what happens, I think you can count on a certain amount of volatility in this market, just simply because it tends to be very choppy, and of course the European Union and the United Kingdom both are interdependent on each other.

Selling rallies

Any type of weakness that I see if the end of a short-term rally, I am willing to sell. With that, I feel that it’s only a matter of time before markets continue to punish the Euro. On the other hand though, if you pay attention to the EUR/USD pair, if we can break above the 1.10 level, then you have to think that perhaps this pair could go bit higher. It really comes down to what’s going on with the Euro because both of these currencies are soft at the moment, but the euro is the one that probably has more negative headlines and sentiment surrounding it.

Keep in mind though that there is a lot of nonsense coming out of Athens at the moment, and that whole situation. Rumors, stories, and quite frankly false Twitter accounts are pushing the markets around from time to time. Be very careful.