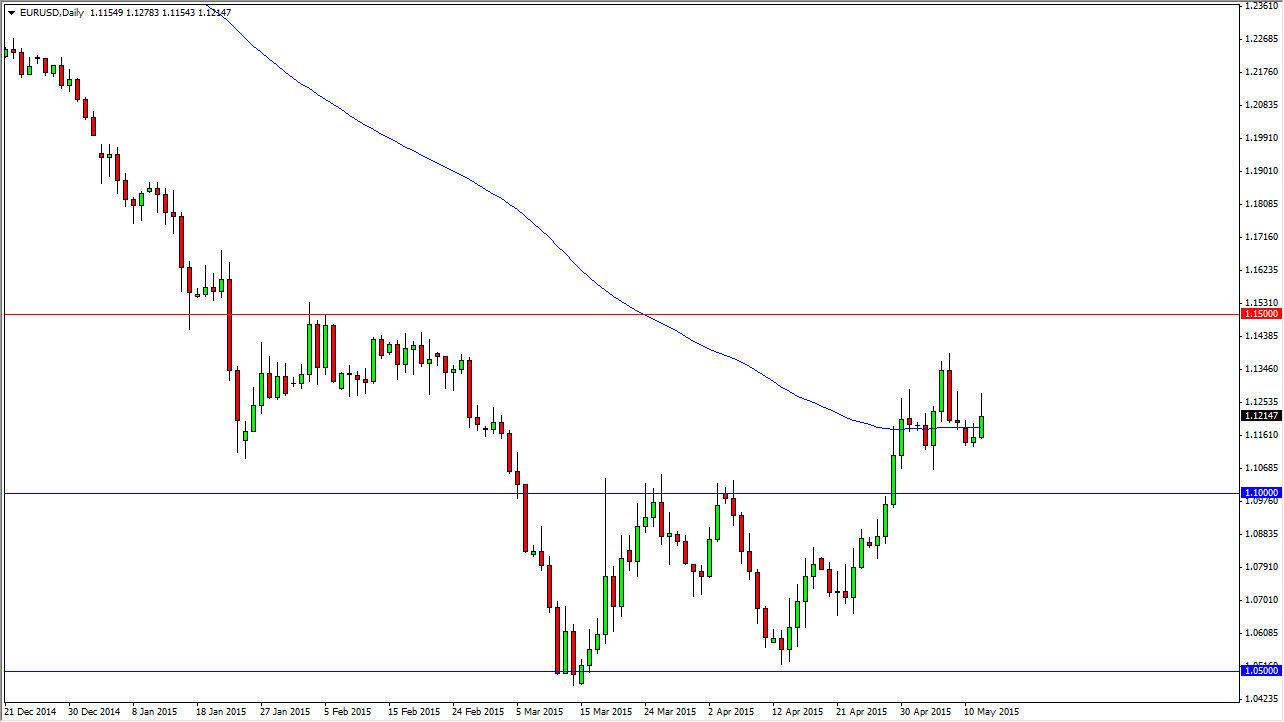

The EUR/USD pair initially broke higher during the course of the session on Tuesday, but pulled back significantly. We are closing the day just above the 1.12 handle, and while that is somewhat bullish, we have been essentially going nowhere over the last several sessions. As you can see on this chart, the 100 day exponential moving average is starting to flatten out, and is right in the middle of this consolidation. In other words, I think we are going to go sideways for the short time being.

We more than likely have a little bit of a downward bias based upon the fact that we have three shooting stars or shooting star like candles over the last four, and we have not come back to retest the 1.10 level for support which of course had been so resistive previously.

Short-term selling, long-term buying

As much as I do not trust the Euro overall, the truth of the matter is that it seems as if the trend is in the process of changing. When a trend changes, it’s never a clean or easy affair. Expect a lot of choppiness, and that’s exactly what we are getting. The idea of pulling back 200 pips to find support isn’t exactly difficult to imagine, and with that I feel that it’s only a matter of time before the buyers reenter. We have seen a nice W shape pattern below, which ironically enough coincides very nicely with oil. In other words, it’s a move away from the US dollar in general, and not necessarily everybody going crazy for the Euro all of a sudden.

It doesn’t really matter why a currency pair is moving in a particular direction just that it is. We have to recognize this, and take advantage of it. This is why I look at pullbacks as potential value in this market, at least until we break well below the 1.10 level. Once that happens, all bets are off. However, I think we’re going to attract enough buying pressure this point that eventually we will see the Euro go much higher.