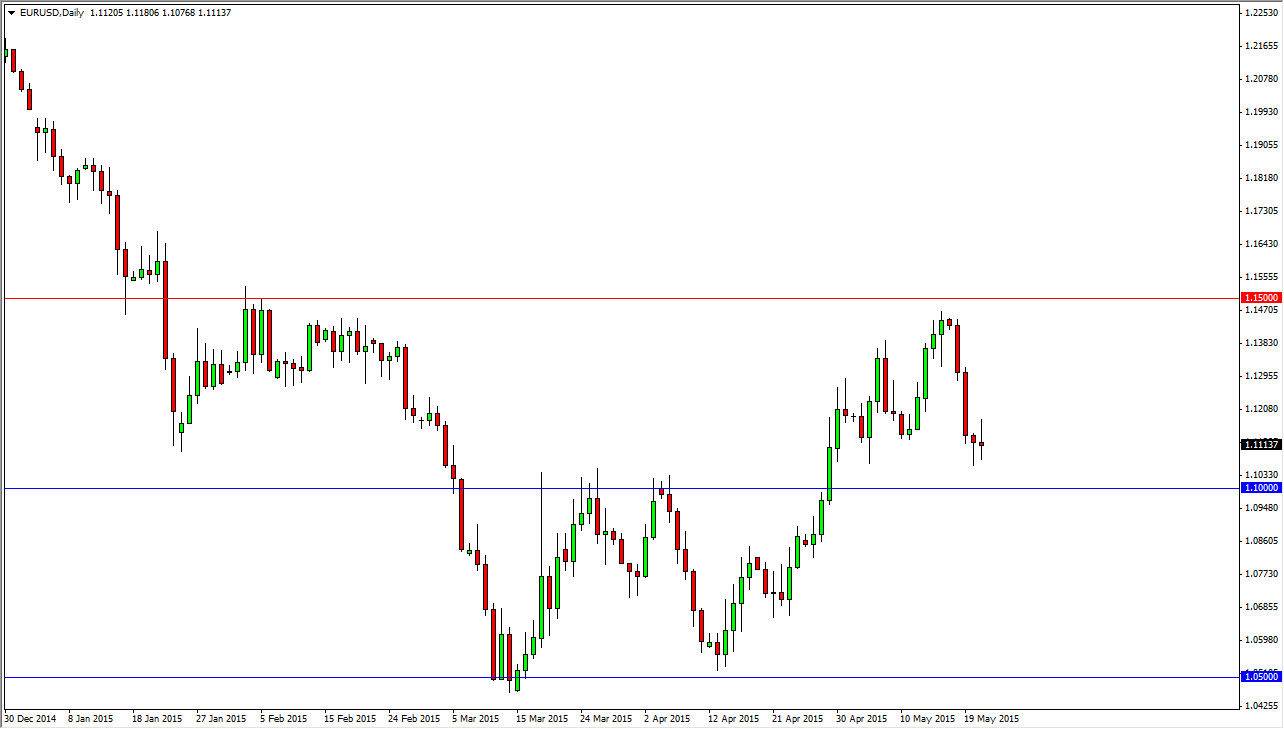

The EUR/USD pair went back and forth during the course of the day on Thursday, testing the 1.11 level for support. The area below all the way down to the 1.10 level continues to offer support as well, and as a result it’s probably only a matter of time before the buyers step in. We believe that this market continues to bounce around in this general vicinity, but I need to find some type of supportive candle in order to go long. The other scenario in which I start buying is if we break above the top of the range for the session on Thursday. By doing so, I would anticipate this market heading to the 1.14 level next. Above there, there is significant resistance by the 1.15 level, and a move above that would be a signal for a trend change in general.

Buying dips

I will continue to buy dips on short-term charts, and most certainly will buy dips once we break out to the upside as that trend change would in fact be a signal that we have entered a bit of a “buy-and-hold” type of situation. In fact, I will not only buy above the 1.15 level, but continue to add to it every time we pullback in order to amass a massive position.

On the other hand, we broke down below the 1.10 level, I would have to rethink the entire thing, as that would be rather bearish. We need to hold the line so to speak here in this area in order to continue to be bullish, and needless to say it’s probably only a matter of time before we get some type of answer. Right now though, I still believe based upon the hammer that we had printed for Wednesday that the buyers are most certainly still below. With this, I can only buy at this point, but again if we break down below the 1.10 level, I will reassess the situation and go from there.