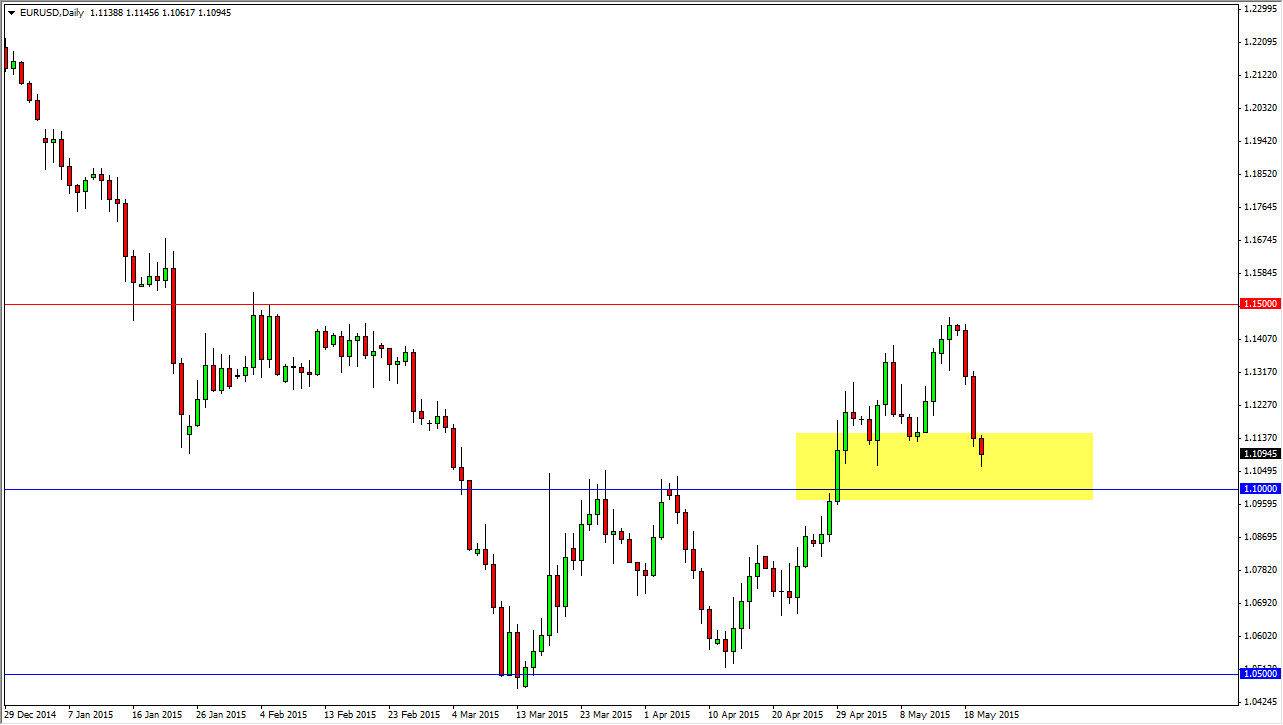

The EUR/USD pair fell during the day again on Wednesday, but we are starting to approach an area that I believe will be rather supportive. I think that somewhere between the 1.11 level and the 1.10 level we will find enough support to turn things back around. After all, breaking above the 1.10 level was a significant breakout, but it has yet to be retested for support. Typically, a breakout will see the market come back to that area and then find support to continue going higher. I think that’s what were about to see in this marketplace, and as a result I am patiently waiting for some type of supportive action in order to start buying again.

I believe that this market is trying to carve out some type of consolidative area between the 1.10 level on the bottom, and perhaps the 1.15 level on the top. If we can get above the 1.15 level, then it becomes a longer-term “buy-and-hold” type of situation.

On the other hand…

If we break down below the 1.10 level, I think the US dollar will then take over again. This is a very erratic market right now, and quite frankly why wouldn’t it be? You have to think about the fact that there is a lot of concerns coming out of Athens, and that situation hasn’t exactly been fixed. We’ve seen this movie before: the Germans threaten the Greeks, the Greeks threatened to leave, and eventually everybody does something to put a Band-Aid on the entire situation in order to push it back into the future. I think sooner or later there will be some serious issues dealt with, but I’m starting to wonder whether or not the Europeans even care if the Greeks leave.

Ultimately, I think that we will have plenty of buying opportunities, but it’s a market that you have to be patient with. I feel no need to rush into this market right now, because after all we are starting the summer trading season which gets to be a little bit slow at times.